Metals X makes offer to acquire JV partner alongside record Renison production

In a flurry of announcements on the 23 and 24 October, Renison co-owner Metals X has provided three major updates including record Q3 tin production, an unsolicited offer to acquire nearly all of the joint venture, and updated its timeline for the Rentails project.

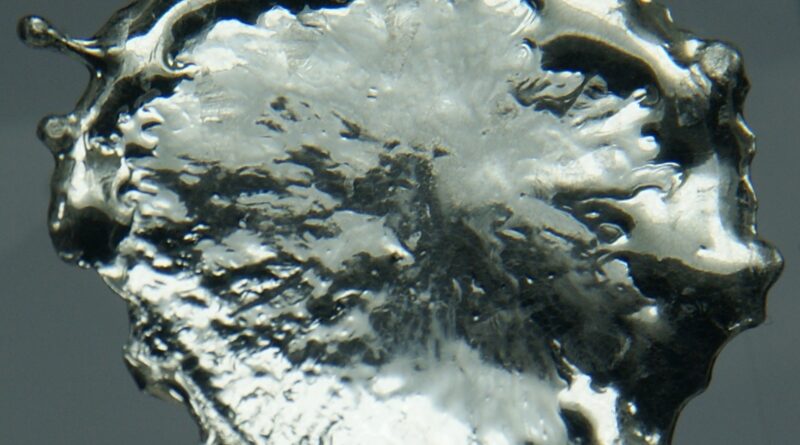

Production from Renison in Q3 surged 16% QoQ to 2,899 t tin-in-concentrate, the highest on record, due to improvements in ore grades processed from 2.11% Sn to 2.36% Sn and enhanced recoveries—now 79.0%—amidst a mill maintenance shutdown in August.

Cash production costs decreased marginally to A$46.94 million (approximately US$31.12 million) in Q3, largely driven by a 1.6% decrease in ore mined. Resource Development and Planning costs increased with greater and deeper drilling activities in difficult ground conditions.

The Q3 All-in Cost was A$30,332/t (approximately US$20,100/t), which combined with a strong tin price and production, resulted in an EBITDA of A$71.10 million (US$47.13 million), 23% higher than the previous quarter.

Separately, Metals X announced it has made an unsolicited offer to acquire all of Hong Kong-listed Greentech’s currently issued shares for HK$0.28 per share and to cancel all outstanding options.

The Renison and Rentails projects are operated and owned by the Bluestone Mines Tasmania Joint Venture, split 50/50 between Metals X and YT Parksong Australia. 82% of YT Parksong Australia is owned by Greentech and the remainder by Yunnan Tin.

The company stated that Greentech had not yet engaged with the offer.

In a third update, the company said the Renison tailings retreatment project (Rentails) is in the ‘notice of intent’ phase which involves preparing and submitting a preliminary environmental impact assessment, and is currently proceeding with a feasibility study.

The three tailings dams contain a total resource of 23.9 Mt, including a reserve of 22.3 Mt, at 0.44% tin and 0.22% copper.

Bluestone expects approval to be granted in late 2026 and construction to take around two years.

Renison’s owners will be pleased with the record production at the historic mine. The last quarter has proven a busy one for Metals X’s capital activity, with the completion of the acquisition of 23% of tin junior First Tin, receipt of $2.5 million from copper producer Cyprium, continuation of its share buy-back programme, and the offer to acquire Greentech. ITA looks forward to further updates on the Greentech offer and the Rentails project.