Newmont benefits from high gold and metal prices

Company’s second quarter results highlight resilient operating model and significant leverage to rising gold prices from diversified portfolio of world-class assets.

Newmont produced 1.3 million attributable ounces of gold and further produced 138 thousand attributable gold equivalent ounces from co-products. The company generated $668 million of cash from continuing operations and $388 million of free cash flow while safely managing the ramp up of operations in care and maintenance.

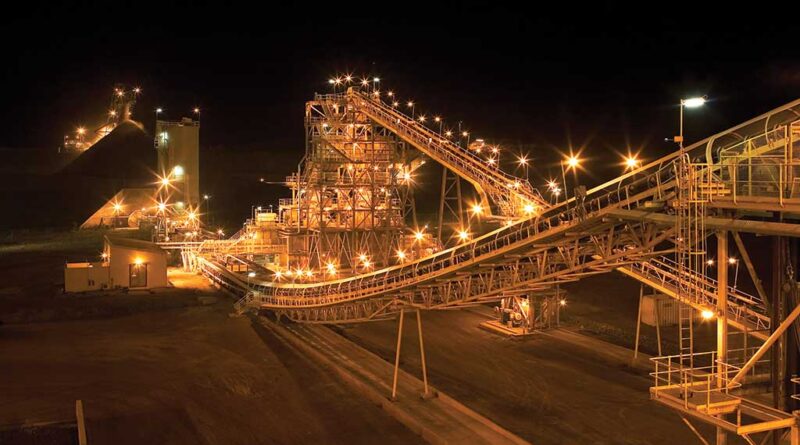

Newmont is the world’s largest gold company and a producer of copper, silver, zinc and lead. The Company’s world-class portfolio of assets spans mining jurisdictions in Africa, North America, South America and Australia. Newmont was founded in 1921 and has been publicly traded since 1925.

“In the second quarter we delivered solid financial performance with $984 million in adjusted EBITDA and $388 million in free cash flow, both substantial increases over the prior year quarter. Our focus remains on ensuring the health, safety and wellbeing of our workforce and neighboring communities as we manage through the Covid pandemic,” said Tom Palmer, President and Chief Executive Officer.

“We safely and efficiently executed restart plans at our mines previously in care and maintenance and Newmont’s world-class portfolio is well positioned to deliver an even stronger second half of 2020. The ongoing favorable gold price environment amplifies our free cash flow generation yet our discipline around capital allocation will not change as we continue to invest in profitable projects and provide shareholders industry-leading returns while maintaining a strong balance sheet,” concluded Palmer.

PROJECTS UPDATE

Newmont’s capital-efficient project pipeline supports stable production with improving margins and mine life. Funding for the current development capital projects Tanami Expansion 2 and Musselwhite Materials Handling has been approved and the projects are in execution. Additional projects not listed below represent incremental improvements to the Company’s outlook.

- Tanami Expansion 2 (Australia) secures Tanami’s future as a long-life, low cost producer with potential to extend mine life to 2040 through the addition of a 1,460 meter hoisting shaft and supporting infrastructure to achieve 3.5 million tonnes per year of production and provide a platform for future growth. The expansion is expected to increase average annual gold production by approximately 150,000 to 200,000 ounces per year for the first five years beginning in 2023, and is expected to reduce operating costs by approximately 10 percent. Capital costs for the project are estimated to be between $700 million and $800 million.

- Musselwhite Materials Handling (North America) improves material movement from Musselwhite’s two main zones below Lake Opapimiskan. An underground shaft will hoist ore from the underground crushers, reducing haulage distances and ventilation costs. The project is 95 percent complete; however, full commissioning has been delayed amidst the Covid pandemic as Musselwhite operations were previously on care and maintenance. The Company expects to commission the project upon completion of the Musselwhite conveyor system by the end of 2020.

OUTLOOK

On May 19, Newmont provided revised 2020 outlook as the Company’s mines that were previously in care and maintenance began ramping up. Now, the Company is reaffirming its latest 2020 production outlook and is providing additional details on its regional and site-level guidance.

Newmont’s 2020 attributable gold production remains at approximately 6.0 million ounces and the Company expects to produce approximately 1.0 million gold equivalent ounces from co-products.

Newmont continues to progress the majority of its development and sustaining capital projects, including Tanami Expansion 2, developing the sub-level shrinkage mining method at Subika Underground and advancing laybacks at Boddington and Ahafo.

However, total 2020 capital expenditure is expected to be approximately $1.4 billion due to reductions in non-essential activities and changes to the development capital schedule for Tanami Expansion 2, which defers some expenditure to 2021.

For exploration and advanced projects, approximately 80 percent of the Company’s exploration budget is allocated to near-mine activities and the majority of those programs continued through the second quarter at sites that were operating.

Newmont’s 2020 exploration and advanced project spend has been lowered to approximately $350 million as all Greenfield programs were suspended and infill drilling programs were on hold at operations in care and maintenance.

The Company is currently ramping up drilling programs and preparing to restart Greenfields activities as soon as local restrictions are lifted in areas of Africa, Australia and South America. Advanced project study work for Yanacocha Sulfides and Ahafo North continues remotely.

Newmont’s 2020 outlook assumes operations continue throughout the remainder of the year without major interruptions.