Okiep Copper study confirms potential for early cash flow

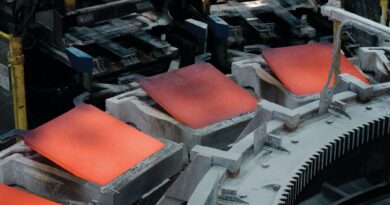

Scoping Study has been completed for a proposed ‘proof-of-concept’-scale copper mining operation at the brownfields Okiep Copper Project, located in the Northern Cape Province of South Africa. The Study was completed as part of Orion’s due diligence program under its Option Agreement to acquire the Okiep Project, with results from the study confirming that:

- Okiep-style deposits have potential to be mined at low cost by both open pit and underground mining methods;

- potential exists to rapidly advance the project to production, with critical permitting processes already underway;

- a ‘proof-of-concept’-scale operation requiring low upfront capital investment can provide commercially attractive returns and early cashflows; and

- potential exists to identify significant operational synergies with the fully permitted Prieska Copper-Zinc Project, also located in the Northern Cape Province, which now awaits funding before mine construction commences.

The Scoping Study is focused on the SAFTA portion of the Okiep Copper Project where Orion is evaluating the purchase of a 56.2% shareholding to partner with the Industrial Development Corporation which currently owns 43.8%.

Orion’s Managing Director and CEO, Errol Smart, commented: “The outcome of the Scoping Study supports the economic merit of developing a foundation phase mining operation while Orion conducts the required work and engineering studies to evaluate the potential to re-establish mining operations with outputs as were previously sustained for decades by previous owners. Newmont managed to produce 30,000 – 40,000 tonnes per annum of copper.

“Most importantly, we now have a benchmark for determining the potential economic merit of the twenty-five targets prioritised by Orion, which have historical mineral resources in place that were not mined. Thus far we have successfully verified and reported JORC 2012 Mineral Resources for an initial six deposits, with this Study now providing guidance for the targeted cut-off grades for open pit and underground mining that are required for these deposits to be of economic merit.”

“Given the current strong copper market conditions and the potential for further price escalation given very firm global demand fundamentals, we believe the potential for early profitable production from a small-scale foundation phase is very encouraging – particularly given the Scoping Study assumes a conservative copper price of USD7,600 per tonne compared to recent prices of over USD10,000/tonne.”