Pan African Resources delivered a robust performance

Despite the challenges presented by COVID-19, Pan African Resources delivered a robust performance, with the salient features being:

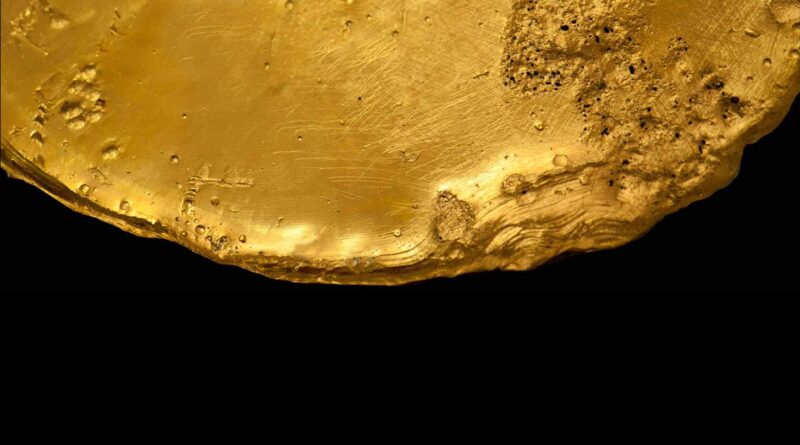

Gold production increased by 4.1% to 179,575oz, compared with 172,442oz for the financial year ended 30 June 2019 and 2% higher than the revised production guidance of 176,000oz.

The Group maintained an industry leading safety performance, despite a slight regression in lost-time injury frequency rate and reportable injury frequency rate, with the regression largely attributable to reduced man hours worked due to COVID-19, when compared to the prior reporting period. Additionally, Barberton Mines achieved 3 million fatality-free shifts during June 2020, a record for the past decade.

Operations have implemented stringent policies and protocols to deal with the ongoing COVID-19 pandemic.

Group net debt decreased by 49% to USD62.5 million from USD123.7 million at December 2019. Net debt at the 2020 year-end was lower than the previously guided USD70 million as a result of better than anticipated production, depreciation in the ZAR/USD exchange rate and disciplined working capital management.

Steady state production was achieved at Evander’s 8 Shaft pillar during June 2020, with expected production of 30,000oz per year for the next three years.

Development into the first target block on 42 level of Barberton’s New Consort Mine – Prince Consort Shaft was completed during June 2020, with highly prospective grades recovered during the last month.

The Pan African board has approved the construction of a 10MW solar power plant at Elikhulu, with the plant expected to materially reduce electricity costs, post its 12-month construction period.

The independent feasibility study review for Evander’s Egoli project was completed, with detailed scheduling now underway, and the Group exploring funding options for its development. The project is expected to contribute incremental annual production of between 60,000oz to 80,000oz for the Group, over its minimum life of 9 years.

The feasibility study projects steady state annual production of 72,000oz in year 2, at an all-in sustaining cost of under USD1000/oz. This life of mine excludes the Inferred Mineral Resources of 6,26Mt at 9,68 g/t (1.95 Moz), which will be accessed once underground development is in place.

Production guidance for the 2021 financial year has increased to approximately 190,000oz.

“Pan African has demonstrated the resilience of its operations with an improved performance for the year, especially when taking into account the challenges posed by the COVID-19 pandemic. The flexibility inherent in our operations confirms the quality of these mines and their ability to withstand short term disruptions and still deliver on our targets,” Pan African CEO Cobus Loots commented.

The Group has further prioritised its focus on our Environment, Social and Governance initiatives, with increased rehabilitation spend and board approval for sustainable development projects, including the renewable energy solar plant at Elikhulu and large scale agriculture projects at

A feasibility study for a solar plant has also been initiated at Barberton Mines.