Pan African revenue up by 16.8%, supported by 4.9% increase in gold sales

Pan African Resources has delivered an outstanding set of operational and financial results for the 2024 financial year. Notably, revenue increased by 16.8%, supported by a 4.9% increase in gold sales to 184,885oz (2023: restated 176,216oz) and an 11.3% increase in the average US$ gold price received during this period. The increased production and revenue demonstrate that steps taken to improve operational efficiencies are yielding positive results.

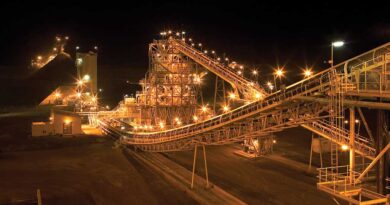

The Group has made significant progress in advancing its growth projects, with the development of Evander Mines’ 24 to 25 Level project and the commissioning of the MTR project being prioritised.

Total capital expenditure for the year amounted to US$172.4 million (2023: US$113.0 million), which resulted in an increase in net debt to US$106.4 million, relative to net debt of US$22.0 million in the previous financial year.

AISC has increased marginally to US$1,354/oz (2023: restated US$1,309oz), resulting in an AISC margin of 32.8% (2023: 27.7%) earned on the average 2024 financial year gold price of US$2,015/oz (2023: US$1,811/oz).

Cash holdings declined to US$26.3 million (2023: US$34.8 million) due to project-specific

capital expenditure, while net cash from operating activities declined to US$90.7 million (2023: US$100.1 million) as a result of the payment of increased income tax and finance costs.

Liquidity remains healthy, with access to immediately available cash and undrawn facilities at financial year-end of US$95.0 million (2023: US$84.7 million). These outstanding results are largely attributable to Pan African’s culture of strict capital allocation discipline and circumspect investment decisions.