Pilbara lithium producer net profit up 326% in FY23

Australian lithium producer Pilbara Minerals reported Friday that in the year ended June 30 2023 (FY23), the company produced 620.1 kt of spodumene concentrate, 64% higher than FY22 and at the top end of production guidance.

In a press release, the company noted that the increase in production for the full year was driven by a combination of product grade strategy and improvements in productivity.

Pilbara said it delivered strong financial performance across all key metrics in the reporting period with Group revenue increasing 242% to A$4.1B (~$2.6B), driven by a 68% increase in sales volumes and an 87% increase in average estimated realized price.

Moreover, Group EBITDA increased 307% to A$3.3B (~$2.1B) following increased sales volumes with operating leverage supporting a 13% increase in EBITDA margin to 82%.

Importantly, the company said its statutory profit after tax increased 326% to A$2.4B (~$1.5B) from the Group’s maiden profit of $561.8M in FY22.

There was also a significant increase in the company’s balance sheet strength in FY23 driven by a A$2.7B increase in cash to A$3.3B as at 30 June 2023 with cash and undrawn facilities providing total liquidity of A$3.5B (~$2.2B).

Following the outstanding FY23 financial results, Pilbara said it has determined a fully franked final dividend of 14 cents per share to shareholders (FY22: zero).

Pilbara also announced a 35% increase in ore reserves to 214Mt which has enabled the company to commence a new study to explore further expansion of production capacity beyond the P1000 project.

According to the company’s statement, the long-term outlook remains “very positive” for battery grade lithium raw materials with continued adoption of EVs and battery storage and an expected growing deficit as anticipated demand for lithium outstrips expected supply.

Commenting on the results, Managing Director and CEO Dale Henderson said, “The FY23 period has been an exceptional year for Pilbara Minerals across all fronts. Strong operational performance within a healthy pricing environment for lithium products has translated to an impressive set of financial outcomes for the business and our shareholders.

“This strong financial result has enabled the Board to support a fully franked final dividend of 14 cents per share resulting in a total dividend of 25 cents per share for FY23.”

“It has been a very successful year for Pilbara Minerals, including strong operational performance, progression of the mine expansion and progress with the company’s downstream chemicals strategy,” he added.

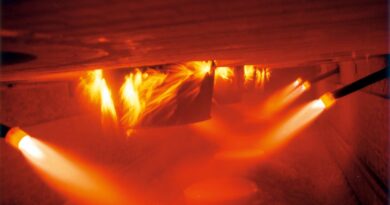

Pilbara Minerals is the leading ASX-listed pure-play lithium company, owning 100% of the world’s largest, independent hard-rock lithium operation. Located in Western Australia’s resource-rich Pilbara region, the Pilgangoora Operation produces a spodumene and tantalite concentrate.