Platinum price outpaces palladium and gold as it reaches 6 years high

This week has seen platinum prices trading at their utmost level in more than six years amid improved industrial demand and continuing attention from investors, who are gambling on the valuable metal to play a key role in the shift to environmentally-clean energy.

Additionally, expected rise in Chinese jewellery demand and concerns over vulnerable South African supplies are driving prices to high levels. Analysts also expect that an economic recovery would boost demand for the autocatalyst metal and lead to a supply shortfall.

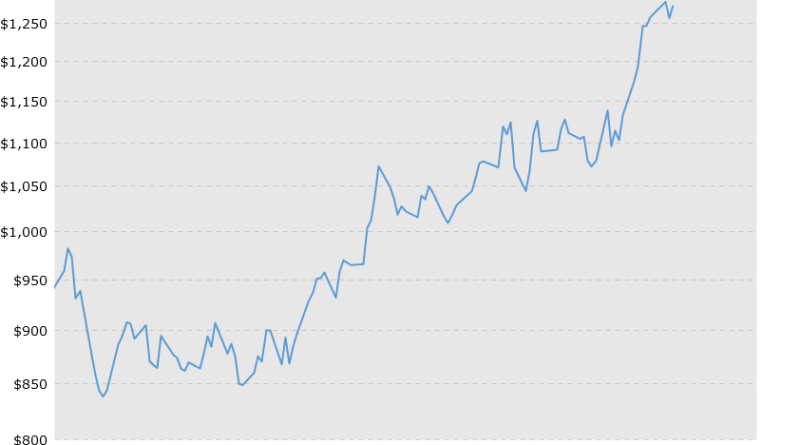

On Monday platinum traded as high as $1,285.17 an ounce, the highest level since January 2015. Prices have since pulled back slightly from that level, but the metal is still on pace to end the week with a double-digit percentage gain.

So far this year the spot platinum price is up more than 16% (gold 6% down, palladium 3% down), but the metal still trades below peers palladium and gold. On Saturday evening, spot platinum was at $1,277.41 by 11.06pm.

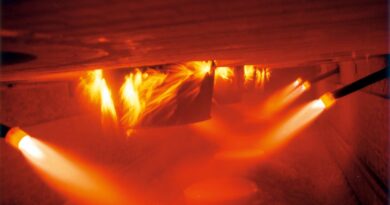

Mining platinum can be a challenging and laborious task, and only about 170 tonnes of the metal is unearthed annually, compared to gold’s 3,300 tonnes.

World platinum production passed eight million ounces in 2017, but had fallen to just over six million ounces by 2019.

More than two thirds of global platinum production occurs in South Africa, with Russia in a distant second place.