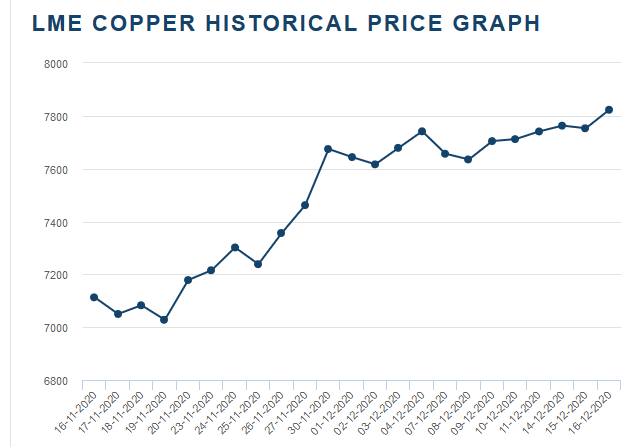

Copper prices spiral to 7-year high

Not far from a benchmark of $8,000/t we need to point out that copper has historically been used by traders as a short-hand stethoscope for the health of the global economy. On 17 December 2020, the London Metal Exchange (LME) price hit its highest level since March 2013, closing at US$7,823/t. Iron ore, nickel and aluminium are also buoyant and so too is an agricultural commodity such as soybeans.

Copper has behaved unpredictably through 2020. Copper prices crushed 27% to a low of US$4,617/t in late March as the global impact of COVID-19 became apparent, but the red metal bottomed out and then began to rise, completing a full recovery to its January starting point by the end of July.

Prices crept abstemiously higher through the third quarter but then gained momentum from October onwards, aided by the depreciation of the dollar after the US presidential election result. All in all, Copper has rallied 68% in the eight months from its March low, making it the most resilient of all base metals.

According to Roskill four factors have battered the market during 2020. Firstly, the negative impact on demand from the COVID-19 recession, closely followed by interruptions to international trade flows in scrap caused by a combination of low prices, operational problems and strict Chinese import quotas.

Thereafter came mine production disruptions in South America caused by infections and new workforce safety protocols, and finally an unexpectedly strong resurgence in Chinese cathode buying for scrap replacement, improving consumption, restocking and stockpiling purposes.

There has been a 0.7Mt build in unreported copper stocks, held by producers, consumers, traders, provincial stockpiles and strategic stockpiles in China. These excess volumes have now been permanently denied to rest-of-world consumers.

Roskill says this is the main factor that has driven up copper prices far beyond where fundamentals would reasonably dictate. In 2021, an improvement in mine supply and a normalisation in the scrap market will be balanced by stronger demand in the rest-of-world and a deceleration in Chinese growth.

It is unfortunate that once again South Africa will lose out on a commodities boom because of ANC government policy that has stunted the sector and deterred investment on the altar of outdated ideology. Ironically, rich countries like Australia, Canada and the US benefit from strong demand and pricing for commodities the most.