Platinum swells to six-year high amid diminished supply

Platinum has been trading above $1,250 per troy ounce, and even touched the 6-year high of $1,302/oz in mid-February, as some investors turned to platinum as a cheap alternative to gold as a hedge against rising inflation. Historically, platinumreached an all time high of 2290 in March of 2008.

Platinum has been supported by robust demand from the automotive sector due to the global tightening of auto emission rules and US President Joe Biden’s push for greener policies.

The bull run is expected to continue as automakers in China and North America are starting to switch to platinum from more expensive palladium in autocatalysts, along with new uses such as hydrogen fuel cells.

At present, the world needs more platinum than miners can produce – the price of the metal must rise and it does. At the moment, due to the COVID-19 driven disruption, the PGM markets are in a unique situation.

PGM supply last year diminished due to Covid-19 lockdowns as mines shut down, refineries operated at a fraction of the normal output and metal recycling disappeared as scrap collection ceased. In total, the worldwide supply of platinum fell by 20%.

Traditionally, the demand for PGMs was largely based on the auto-industry. Their use in the autocatalytic converters was widespread. By looking at global new vehicle sales, one’d have a more or less reliable way to measure platinum demand.

Then the demand for new vehicles slumped. Johnson Matthey estimates autocatalyst demand plunged by 22% as diesel car production in Europe fell steeply. They also point to the lower demand from Chinese jewellery manufacturers which slumped a 20-year low.

The low platinum price prompted buying from both ETF investors and investors buying platinum bars. The buying fever was so distinct, physical bars saw all-time record volumes going through in March 2020.

By the end of 2020, autocatalytic converters accounted for around 32% of global demand, jewellery made up around 23% while investment demand accounted for around 13%. To compare, the direct metal investment in 2018 accounted for only 1% of the demand for global ounces. The surge in physical investment caused the market staying in deficit.

With the vaccine rollout progresses and the world slowly returning to normal, industrial and automotive demand should recover to pre-pandemic levels at some point this year.

But supply will increase as well, mainly due to a refining backlog at Anglo American Platinum’s converter plant being gone. But longer-term, if the investment appetite holds, while industrial and auto-manufacturing demand ramps up, the deficit will grow quickly, and prices will rise.

There has been an under investment in the mining and exploration of new platinum deposits as new shafts and operations have been put on hold. If the mining companies aren’t exploring and developing new projects, supply will eventually be curtailed.

In 2020, industrial application accounted for 2.2 million ounces (roughly 32%) of the demand last year. The applications in petrochemical, petroleum refining, silicon and glass industries for platinum are only growing. As technology advances, the diverse range of applications of platinum bode well for future demand.

With the rise of the electric vehicle, the move away from fossil fuels suggests that a third of platinum demand may evaporate soon.

But, platinum acts as an effective and durable catalyst in hydrogen-powered fuel cell electric vehicles (FCEVs) thatuse a type of fuel cell known as the Polymer Electrolyte Membrane (PEM). Platinum-based fuel cells are also cost-effective, cleaner and more reliable than alternatives such as diesel generators.

Platinum is mostly traded on the New York Mercantile Exchange, the Tokyo Commodity Exchange and the London Bullion Market. Platinum futures contract trades in units of 50 troy ounces. South Africa accounts for 80% of production followed by Russia and North America.

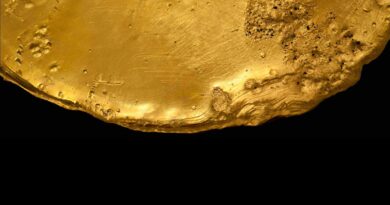

Platinum is among the world’s scarcest metals and is used primarily in the production of automotive catalytic converters, in petroleum refineries and in the chemical and electrical industry.