Polymetal posts gold equivalent production declines 9% in Q2

Russia’s Polymetal, a senior global gold and silver producer, reported today that its quarterly gold equivalent production decreased by 9% year-on-year to 326 Koz in Q2 2022.

According to the company’s statement, a decrease in quarterly gold equivalent output was due to lower grades and planned long maintenance shutdown at the Amursk POX and reduced output from Kyzyl and Albazino.

The company said it reiterates its full-year production guidance of 1.7 Moz of GE (1.2 Moz in Russia and 500 Koz in Kazakhstan), however Polymetal noted a risk of underperformance given persistent lockdowns and logistical constraints in Chinese ports and railway.

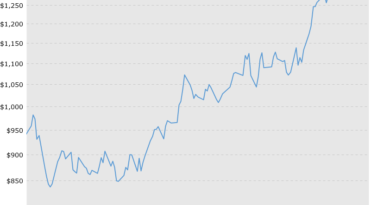

The company’s revenue for the quarter recorded a 36% decline y-o-y to US$ 433 million, while H1 revenue was down by 18% to US$ 1,048 million (US$ 605 million Russia and US$ 443 million Kazakhstan).

Polymetal explained that this negative dynamics was the result of lower sales volumes on the back of inventory accumulation, while the average realized price was marginally higher.

The company also said that its net debt as of the end of Q2 stood at approximately US$ 2.8 billion, adding that a quarterly increase of US$ 0.8 billion was driven by bullion and concentrate inventory accumulation, accelerated purchases of equipment and spares, funding of the critically important contractors and suppliers, and upward US$ re-valuation of ruble-denominated debt driven by significant Rouble strengthening during the quarter.

“In Q2, we hit our production targets and are on track to meet our full-year guidance. International sanctions against Russia continue to have a material impact on sales, procurement and logistics. The management is fully focused on maintaining operating and financial stability of the company,” commented Vitaly Nesis, Group CEO of Polymetal.

Polymetal International is a senior global gold and silver producer with assets in Russia and Kazakhstan. On July 19 2022, Polymetal announced it is considering disposing of its Russian assets in a shift to focus on its operations in Kazakhstan.