PPC removes financial obstacles for DRC plants

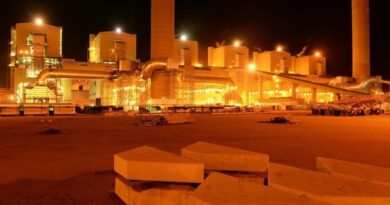

Johannesburg – PPC reached a deal to restructure debt at its PPC Barnet business in the Democratic Republic of Congo (DRC) and as it reported improved sales. It has also made good progress with the sale of its PPC Lime business.

In an update to investors, the cement producer said a deal with PPC Barnet’s lenders terminated their recourse to PPC, which could have amounted to $175-million (R2.58-billion).

The settlement agreement is effective on the payment of a final deficiency settlement amount of $16.5-million, which it expects to make early this month. It has also entered a binding term sheet to restructure the $175-million senior debt in PPC barnet as part of implementing a sustainable capital structure for the business.

The conclusion of the Settlement Agreement represents a significant milestone in the restructuring and refinancing project, providing clarity on what has been a significant overhang on the Group by removing a potential $175 million liability from the Group’s balance sheet,”

PPC said. “It is also expected to restore investor confidence in the Group and free up management time to focus on core operations and other long-term strategic initiatives.”

In Ethiopia, associate company Habesha had started to deliver positive month-to-month earnings before interest, tax, depreciation, and amortisation (Ebitda) in its ramp-up phase. Habesha had appointed advisors to develop a financial restructure plan to optimise its capital structure. While it saw long-term value in the business, PPC said it had no obligation to support the business nor invest further capital.

While the process to raise capital in PPC International was still underway, subject to potential deferral pending the outcome in the Habesha restructuring, it was no longer required for the implementation of a sustainable capital structure for the group following the resolution of its DRC exposures.

The group said its SA lenders had also agreed to defer the timing of a capital raise of no less than R750-million, aimed at degearing its local balance sheet, by six months to the end of September and would review the need for the rights issue if it continued to reduce debt.

PPC said it experienced a double-digit growth in cement sales from last July up to February despite new Covid-19 restrictions in some markets. Group revenue increased by 7% period-on-period for the eleven months ended February and 14% for the five months ended February, driven primarily by strong cement demand in South Africa.

However, it said cement imports continued to pose a threat to the industry, rebounding strongly after easing of the lockdown restrictions.