RB Platinum: Strong performance hampered by COVID-19

As the sudden and unprecedented shock caused by the COVID-19 pandemic has impacted all areas of its business, Royal Bafokeng Platinum (RBPlat) implemented measures designed to manage the impact and spread of the virus by continuing its operations within the broader national guidelines, as well as its own health and safety framework, while also limiting the economic impact on the community through its community support programme.

The impact of the shutdown due to the national lockdown on production and cost of mining and processing has been severe with necessary care and maintenance, shutdown and restart costs being incurred in the process.

The return of RBPlat employees to the operations from 20 April 2020, together with the screening and testing resulted in limited production in April and the restrictions in production capacity in May led to a significant increase in unit cash costs for these months.

With the recommencement of operations at full capacity from the beginning of June, RBPlat continues to strictly adhere to protocols to minimise the risk of outbreaks at its operations and in the community.

KEY FEATURES OF RBPlat PERFORMANCE

Financial capital

– 297.2% increase in EBITDA to R2 087.8 million

– 573.6% increase in basic headline earnings per share to 335.3 cents

– Net cash position of R701.8 million

– RPM deferred consideration settled in full

Manufactured capital

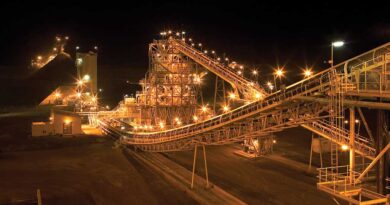

– Strong performance at BRPM and Styldrift hampered by 45 production days lost due to COVID-19

– 12.9% decrease in 4E ounce production to 173.5koz

– 10.1% increase in total cash operating costs to R2 896 million

OUTLOOK AND COMPANY GUIDANCE

Visibility on how COVID-19 will affect operations in the second half of the year is limited and RBPlat has revised its guidance in line with its first half achievements and wider uncertainty around the future impact of the pandemic on company’s operations.

Group production guidance for 2020, is therefore revised to be between 3.55Mt and 3.80Mt at a 4E built-up head grade of 3.98g/t to 4.03g/t, yielding 380koz to 405koz 4E metals in concentrate. Unit cost guidance for the Group is forecast to be between R15 600 and R16 200 per 4E ounce.

Group capital expenditure for 2020, including escalation and contingencies, is forecast to be approximately R1.8 billion.

Styldrift mining and infrastructure for the 230ktpm ramp up footprint (R700 million), the Maseve plant expansion (R260 million), tailings storage facility upgrades (R250 million) and Styldrift replacement capital (R200 million) will be the main drivers. SIB expenditure for the Group is expected to be approximately 6% of total operating costs.