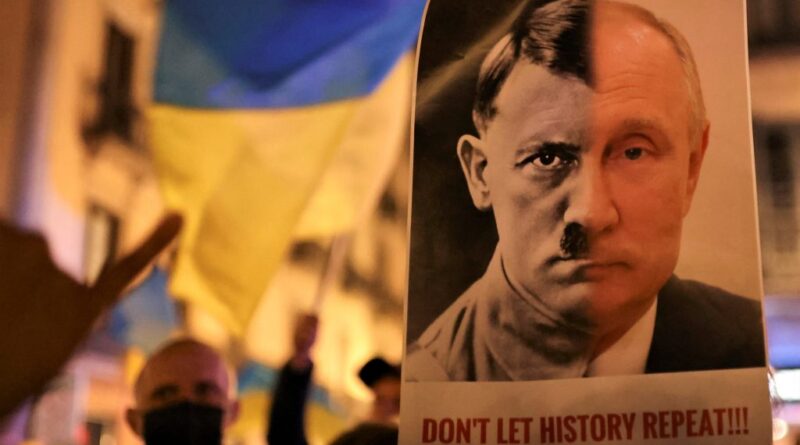

Russia’s invasion of Ukraine to shake platinum production

Russia’s invasion of Ukraine at the end of February sent shockwaves through the markets. The PGM industry in particular is geographically exposed, due to the significant contribution Russia makes to the supply of raw materials (especially for palladium).

Despite the automotive sector finding itself at the behest of yet another wave of supply shortages and lower production, platinum demand from this sector remained flat year-on-year as tighter emissions supported higher metal loadings.

Industrial demand experienced a sharp decline from record levels, falling by 25% (-175 koz) year-on-year, as there was no repeat of the exceptionally high capacity installations in the glass sector seen in Q1’21. Investment demand saw net outflows for the third consecutive quarter, as ETF holdings declined by 169 koz.

With most demand segments lower, total demand fell 26% (-541 koz) year-on-year, but this was offset by a drop in both refined mine production (-185 koz) and secondary supply (-103 koz). Compared to the Q4’21, the market surplus of 167 koz was 60% lower, reflecting weakened demand as well as supply.

SUPPLY

Refined platinum production declined 13% (-185 koz) year-on-year to 1,279 koz, primarily on lower output from South Africa. South African production fell 16% (-167 koz) year-on-year in part due to the completion in 2021 of the release of semi-finished inventory built up during the Anglo Convertor Plant (ACP) shutdown of 2020.

Maintenance schedules also constrained processing availability in Q1’22 as Implats undertook a rebuild of its number 3 furnace. Operations faced headwinds during Q1’22 as COVID-19 and geopolitical events stressed supply chains, impacting equipment deliveries and so disrupting mine output.

Safety-related stoppages also continued to weigh on output. Production at Mogalakwena, Anglo American Platinum’s flagship mine, was curtailed by heavy rainfall in the period.

Russian output declined 11% (-21 koz) year-on-year compared to Q1’21, which was buoyed by a release from semi-finished inventory due to the commissioning of a new production line at Nornickel. Other regions remained largely flat year-on-year.

RECYCLING

In Q1’22, global platinum recycling fell considerably short of Q1’21 dropping by 20% year-on-year (-103 koz) to 415 koz, as a result of the chip shortage and China’s zero-COVID policy; resulting in the lowest output since Q2’20.

Autocatalyst recycling accounted for most of the weakness in the global total, falling by 22% (-84 koz) year-on-year to 299 koz. With constrained new car production and longer lead times for deliveries, lower volumes of end-of-life vehicles are feeding through to scrap yards. Elsewhere, platinum jewellery recycling declined 16% (-19 koz) to 99 koz as COVID lockdowns restricted consumer movement in China resulting in weak jewellery demand and in turn, undermining scrap collection opportunities., as consumers often trade older pieces in when purchasing new ones.