Sibanye-Stillwater: earnings are expected to be 47% to 52% lower

Johannesburg: Sibanye-Stillwater in its trading statement and operating update for the six months ended 30 June 2022 advises that its Earnings and Headline earnings for H1 2022, are expected to be 47% to 52% lower compared to H1 2021.

The decrease in EPS and HEPS for the period compared to the comparative period in 2021 is primarily due to the following:

- A reduction in gold production from the SA gold operations for Q2 2022 due to the industrial action which commenced on 9 March 2022 and was finally resolved on 13 June 2022. In addition and as reported the suspension of processing activities in late December 2021, to allow for the reinforcement of the Beatrix tailings storage facility (TSF), resulted in no ore being processed or sold from the Beatrix operations for Q1 2022

- Production from the US PGM operations for Q2 2022 was also significantly impacted by the severe regional flooding in Montana on 12 and 13 June 2022, with the Stillwater operations being suspended for a seven-week period

- Lower relative precious metals prices, with the average rand 4E PGM basket price 19% lower for H1 2022 and the average US dollar 2E PGM basket price 15% lower than H1 2021

- This decline in average commodity prices also resulted in the Group recording a 45% decline in share of results of equity-accounted investees after tax compared to H1 2021

- These negative financial impacts were partially offset by lower royalties and mining and income taxes

Operating update for H1 2022 compared to H1 2021 4E PGM production from the SA PGM operations, including purchase of concentrate (POC) of 849,152 4Eoz, was 9% lower than for the comparative period in 2021. A 9% decrease in underground 4E PGM production to 751,717 4Eoz was partly offset by a 6% increase in surface production of 72,089 4Eoz, with third-party purchase of concentrate treated at the Marikana smelting and refining operations of 25,346 4Eoz, 27% lower due to the winding down of two third party purchase of concentrate contracts in Q4 2021.

Mined 2E PGM production from the US PGM operations of 230,039 2Eoz (H1 2021: 298,301 2Eoz) was 23% lower year-on-year primarily due to the temporary cessation of operations at the Stillwater mine following the regional flooding in Montana on 12 and 13 June 2022 and mining flexibility and labour constraints which continued to impact productivity at both operations.

2E PGM production from the Stillwater mine was 15,000 2Eoz lower compared to Q1 2022 due to the flood impact, with a total 60,000 2Eoz of planned production impacted during the seven-week suspension of operations at the Stillwater mine.

Recycling ounces fed during H1 2022 decreased by 10% to 361,333 3Eoz year-on-year mainly due to ongoing logistical constraints globally and adjustments to the blend ratio of high grade recycle feed following the reduction in volumes of mined concentrate post the flood event.

Production from the SA managed gold operations (excluding DRDGOLD) decreased by 77% in H1 2022 to 3,128kg (100,568 oz) compared with H1 2021 due to no material gold production occurring during the three-month industrial action and from the Beatrix operation during Q1 2022, due to the suspension of processing operations to allow for precautionary reinforcement and buttressing of the Beatrix TSF from 28 December 2021. Maintenance work on the Beatrix TSF was completed by the end of May 2022.

During Q1 2022, the acquisition of the Sandouville nickel refinery in Le Havre, France was concluded. Sandouville produced 3,499 tonnes of nickel metal, 1,066 tonnes of nickel salts and 113 tonnes of cobalt chloride since acquisition. Integration of the Sandouville refinery continues.

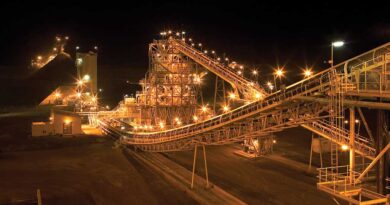

Sibanye-Stillwater is a multinational mining and metals Group with a diverse portfolio of mining and processing operations and projects and investments across five continents. The Group is also one of the foremost global PGM autocatalytic recyclers and has interests in leading mine tailings retreatment operations.