Sibanye-Stillwater updates operating guidance due to safety interventions

Johannesburg – Sibanye-Stillwater wishes to advise that it has revised operational guidance for the 2021 year, primarily due to various safety related interventions and measures that have been implemented to reinforce the Group’s primary priority of putting safety first and ensuring the safety and health of its more than 80,000 employees (including contractors).

A Group-wide safety intervention was launched between 28 October and Tuesday 2 November 2021, during which all operations across the Group were suspended to focus on safety and enable full and comprehensive audits of all the operating areas.

Subsequent to this Group safety intervention, however, the SA operations tragically suffered three separate fatal safety incidents between 29 November and 3 December 2021 which resulted in the loss of five of employees.

After careful consideration of accident and injury trends, a decision has been made to suspend operations at the Kloof 1 and Beatrix 3 shafts at the SA gold operations and the Rustenburg Khuseleka shaft at the SA PGM operations until further notice, to enable the regression in safety at these particular business units to be addressed.

In addition, the recent increase in COVID-19 infections has impacted supervisor and senior management availability at our Rustenburg Thembelani shaft, and in the interests of the safety of employees, production at this shaft has also been suspended.

OPERATING GUIDANCE – UPDATE

For the SA gold operations, the Group safety intervention between 28 October and 2 November 2021 and the suspension of Kloof 1 shaft and Beatrix 3 shaft for the remainder of the year has resulted in an estimated 600 kg (19,000 oz) reduction in forecast production. Gold production (excluding DRDGOLD) for 2021 is therefore forecast to be close to the lower end of guidance, between 27,500 kg (884,000 oz) and 29,500 kg (948,000 oz), with AISC forecast at the upper end of the guidance range of between R815,000/kg and R840,000/kg (US$1,690/oz and US$1,742/oz). Capital expenditure for 2021 is forecast at R3,900 million (US$260 million).

The Group safety intervention and the suspension of operations at the Khuseleka and Thembelani mines for the rest of the year is expected to reduce 4E PGM production from the SA PGM operations by approximately 17,000 4Eoz. Despite this, as a result of the solid operational performance from the SA PGM operations, production guidance for 2021 is maintained at between 1,750,000 4Eoz and 1,850,000 4Eoz with AISC between R18,500/4Eoz and R19,500/4Eoz (US$1,230/4Eoz and US$1,295/4Eoz). Capital expenditure is forecast at R3,850 million (US$257 million).

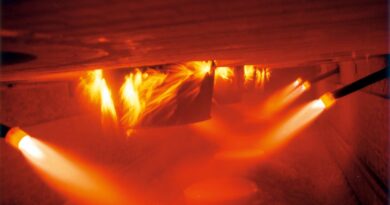

In addition to the Group safety intervention in late October, which was also undertaken at our US PGM operations, 2E PGM production from these operations has been further impacted during H2 2021 by the finalisation of further rail safety enhancements related to the fatal incident in June 2021.

Furthermore, the temporary suspension of ore transport from the Stillwater East operation to allow for the replacement of the bridge that crosses the Stillwater River to the concentrator will further impact on production for the year.

A beam failure on the bridge, detected in November 2021 initially resulted in the reduction of payloads crossing the bridge as a precautionary measure and ultimately informed a decision to rebuild the bridge in the interests of safety.

Repairs are expected to be completed by the end of December 2021 with stockpiled ore from Stillwater East expected to be processed during Q1 2022. As a result of these factors, full year production guidance from the US PGM operations for 2021 has been revised to between 570,000 2Eoz and 580,000 2Eoz with AISC guidance revised to between US$1,000/2Eoz and US$1,025/2Eoz as a result of lower forecast production.

Capital expenditure guidance remains at between US$285 million and US$295 million of which 55% to 60% is growth capital. Estimated PGM recycling for the year is unchanged at between 790,000 and 810,000 3Eoz.