SMS restructures amid 2020 pre-tax loss

SMS group, a supplier of metallurgical plants and technology, particularly felt the impact of the coronavirus pandemic in its business with new plants. In the 2020 business year, order intake fell by around 40 percent compared to the previous year to EUR 1,885 million.

The service business, which is included in this figure, proved considerably more stable, decreasing by only 10 percent to EUR 665 million. The order backlog declined to EUR 3,028 million. This means that orders remain at a high level, though they no longer ensure full capacity utilization in all product areas. At EUR 2,745 million, sales were 6.5 percent down on the previous year.

Even though the instrument of short-time working was used at a very early stage, the 2020 result was impacted by the consequences of the coronavirus pandemic and by provisions for the restructuring measures in Germany. As a result, SMS closed the business year with a clear loss: the pre-tax result stood at EUR -165 million.

Net liquidity, on the other hand, was bolstered by around 4 percent to EUR 863 million. Investments more than doubled compared to the previous year, totaling EUR 83 million.

RESTRUCTURING TO SECURE COMPETITIVENESS ON THE GLOBAL MARKET

For the coming years, SMS expects its core business of metallurgical plant construction to see stable development, though remaining short of its pre-pandemic level. To strengthen the competitiveness of the German sites and adjust the cost structure to the lower level of capacity utilization, personnel costs will have to be cut by approximately another EUR 100 million. Talks with the trade union IG Metall have already commenced.

POOLING OF DECARBONIZATION COMPETENCE

The global steel and non-ferrous metals industry is facing a great transformation challenge. Due to the ambitious environmental and climate targets that have been set in all key steel regions of the world, steel producers are coming under growing pressure to innovate and invest.

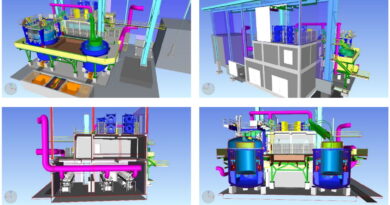

The complete acquisition of Paul Wurth S.A. by SMS in April 2021 has led to all research and development activities in metallurgy and hydrogen technology being brought together under one roof.

SMS group is now in a position to offer the entire range of technologies relevant to the decarbonization of metallurgical processes.

SMS group CEO Burkhard Dahmen says: “With our wide range of ‘bridge’ technologies developed for the decarbonization of the industry, we can support our customers in every phase of the transformation to climate-neutral steel production. This applies to both existing plants and the development of new ones.”

GROWTH IN THE SERVICE AND DIGITALIZATION BUSINESS

Besides decarbonization, the Digitalization, Automation and Technical Service businesses remain the key drivers of new orders. There is a growing trend toward integrated service packages, for example in the form of performance-based agreements.

In addition, the 2020 business year saw an expansion of the service business via strategic buyouts: the acquisition of Vetta Tecnologia S.A. now enables SMS to offer its customers energy management solutions for the highly complex production chains in the metals industry.

POSITIVE OUTLOOK: TURNAROUND IN THE CURRENT BUSINESS YEAR

Many customers are currently reviving projects that had been put on hold and investing in new plant technology. SMS group’s regional focus, which assures greater proximity to markets, has already been bearing fruit. For the current business year, SMS expects order intake to rise clearly and sales to return to the level of 2019.

For the next three years, SMS forecasts a significant recovery in its business, driven in particular by digitalization projects, the further expansion of the service business and the market launch of the joint ventures Primobius (battery recycling) and BOXBAY (port logistics).

Dahmen: “We see that we have chosen the right growth strategy and that it will continue to be successful as we emerge from the pandemic. We are determined to return to our path of profitable growth in the current business year.”