South Korea hydrogen technologies improve demand for platinum

At the end of last year, the South Korean government held its sixth Hydrogen Economy Committee meeting, announcing major policies for accelerating the country’s transition to a clean hydrogen ecosystem and nurturing the hydrogen industry.

During the meeting, a range of policy agendas were discussed, including the implementation of a clean hydrogen certification system and measures to increase the distribution of fuel cell electric vehicles (FCEVs). Crucially, there is a growing expectation that South Korea will expand tax support for clean hydrogen production technologies.

In South Korea the government believes that hydrogen offers the prospect of decarbonisation alongside the promise of economic growth. It has previously announced domestic plans to deploy 300,000 hydrogen FCEVs — including 21,200 buses — and more than 660 hydrogen filling stations by 2030.

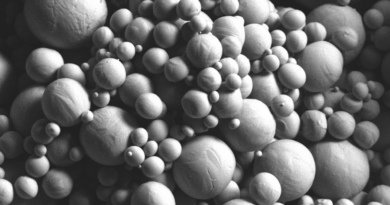

South Korea’s strategy for decarbonising its highly industrialised economy also relies heavily on using green hydrogen. This, together with its FCEV deployment plans, could result in it becoming a significant hub for platinum demand, particularly if its domestic policies also support exports. Platinum is used in proton exchange membrane (PEM) electrolysers to produce green hydrogen and in PEM fuel cells that power FCEVs.

Significant investment

Over US$40 billion of investment is earmarked through public-private partnerships to harness and roll-out hydrogen technologies across the entire value chain in South Korea. For example, the government has plans to create six prototype hydrogen cities.

Major businesses are also driving momentum. Hyundai has invested US$1.1 billion in building two new fuel cell plants in Incheon, near Seoul, which will have production capacity of 100,000 fuel cells per year.Meanwhile, Dooson Fuel Cell is collaborating with HyAxiom and Ballard Power Systems to develop PEM fuel cell mobility applications, to include the supply of fuel cell electric buses and hydrogen refuelling infrastructure to the Korean market.

SK Plug Hyverse, a joint venture between US PEM electrolyser and fuel cell manufacturer Plug Power and South Korean energy company SK E&S, is set to establish a gigafactory in Korea for large-scale production of PEM electrolysers. It is also actively involved in expanding Korea’s domestic green hydrogen sector through the use of PEM electrolysis technology and has participated in two ongoing electrolysis demonstration projects on Jeju Island.

Air Liquide Korea has joined forces with Lotte to develop a new generation of large-scale hydrogen filling centres in South Korea. The first two units are strategically located in the industrial regions of Daesan and Ulsan to serve the densely populated regions of Seoul metropolitan area and Gyeonggi province in the northwest, and Ulsan/Daegu/Busan metropolitan areas and Gyeongsang provinces in the southeast.