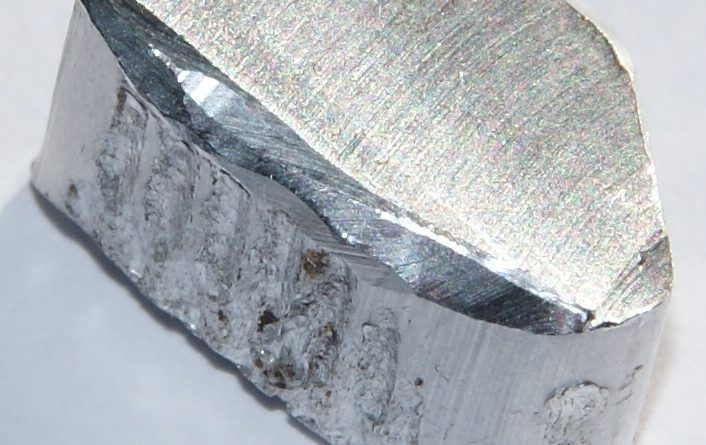

Best aluminium production achieved at Hillside smelter

At its quarterly report ending March 2020, South32, among other results, reports on the record year to date production at Hillside Aluminium, where the smelter has a government exemption to maintain production during the lockdown.

The company has also increased Alumina production by 4%, achieving record year to date production at Brazil Alumina and maintained higher rates of calciner availability at Worsley Alumina as South32 delivered initiatives to sustainably increase to nameplate capacity.

“At our operations, we have delivered a strong operating result in the year to date, highlighted by record production at Brazil Alumina and Hillside Aluminium,” said Graham Kerr, South32 CEO.

Hillside Aluminium saleable production increased by 1% (or 4kt) to a record 540kt in the nine months ended March 2020 as the smelter continued to test its maximum technical capacity, despite the impact to production from load-shedding.

Hillside Aluminium is considered an essential business in South Africa for the maintenance of power generation, given the role it plays in the sustainability of Eskom’s generation network. As a result, the smelter continues to operate despite the nationwide lockdown that is currently scheduled to expire on 30 April, having commenced at midnight on 26 March.

FY20 production guidance has been withdrawn due to the uncertain impact of measures or restrictions that may be required to contain the spread of COVID-19.

Mozal Aluminium saleable production was unchanged at 201kt in the nine months ended March 2020. Subject to no impact from existing or additional COVID-19 restrictions or measures during the remainder of the financial year,FY20 production guidance remains unchanged at 273kt.

The smelter sources all of its alumina from our Worsley Alumina refinery with approximately 50% priced as a percentage of the LME aluminium index under a legacy contract and the remainder linked to the Platts alumina index on an M-1 basis, with caps and floors embedded within specific contracts that reset every calendar year. As a result the smelter’s cost of alumina was a premium to the index in the nine months ended March 2020.Following a review of activity in response to market conditions and an update to our assumptions for foreign exchange rates over the remainder of FY20, guidance for sustaining capital expenditure has been reduced by US$1M(or 8%)to US$11M.

The company has received government approval to undertake limited activity at its South African manganese ore and export coal operations during the national lockdown, remobilising at a reduced rate in April.

While the company reviewed options for its manganese alloy smelters, the timeline to complete the review has been impacted by government restrictions in response to COVID-19.

On 27 March, South32 placed its South African manganese alloy smelter, Metalloys, on temporary care and maintenance in response to the national lockdown.

On11 February, South32 formed a 50:50 Joint Venture with Trilogy Metals Inc. for the Upper Kobuk Mineral Projects in northwest Alaska (Ambler Metals JV).

The company progressed the sale of its shareholding in South Africa Energy Coal to Seriti Resources Holdings Proprietary Limited (Seriti Resources).