South32 grew its share of aluminium production by 5%

South32 grew its share of aluminium production by 5% in the June 2022 quarter as it closed the acquisition of an additional shareholding in the hydro-powered Mozal Aluminium smelter and achieved first production from the restart of its 100% renewable powered smelter in Brazil.

The cost profile of Southern African aluminium smelters will continue to be heavily influenced by the South African rand, and the price of raw materials and energy. H2 FY22 Operating unit costs are expected to be 15-20% higher than H1 FY22 (previously 10-15%), as both smelters remained profitable by maintaining their strong operating performance which saw them continue to test their maximum technical capacity, despite increased load-shedding.

HILLSIDE ALUMINIUM (100% SHARE)

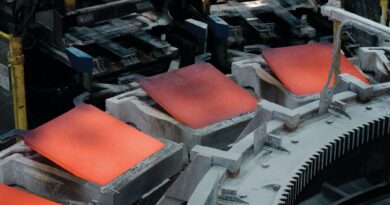

Hillside Aluminium saleable production was largely unchanged at 714kt in FY22 as the smelter achieved 99% of guidance, despite the impact of increased load-shedding. Its first pots utilising the AP3XLE energy efficiency technology were relined during the June 2022 quarter, with the project expected to deliver both volume and energy efficiency benefits, reducing the smelter’s carbon intensity.

Sales increased by 11% in the June 2022 quarter with inventory returning to normalised levels as South32 realised the benefit of initiatives undertaken to establish alternative discharge and cargo shipping options, mitigating poor third-party port performance and ongoing shipping congestion.

MOZAL ALUMINIUM (63.7%[3] SHARE)

Mozal Aluminium saleable production increased by 5% (or 13kt) to 278kt in FY22 with the smelter benefitting from its roll-out of the AP3XLE energy efficiency technology, which partially offset the impact of increased load-shedding to achieve 99% of guidance. Its equity share of production reflects the completion of our acquisition of an additional 16.6% shareholding in the smelter on 31 May 2022, taking South32 ownership to 63.7%. Prior period production and sales numbers have not been restated for this change in ownership (presented on a 47.1% basis).

Aluminium sales increased by 33% in the June 2022 quarter supported by the improvement in quarterly production volumes and the realisation of benefits from initiatives undertaken to optimise its shipping and logistics operations at the smelter.

WORSLEY ALUMINA (86% SHARE)

Worsley Alumina saleable production increased by 1% (or 28kt) to a record of 3,991kt in FY22 as the refinery delivered above its nameplate capacity (4.6Mtpa, 100% basis), realising the benefit of embedded improvement initiatives and surpassing guidance expectations.

Sales increased by 23% in the June 2022 quarter with a carry-over shipment from the prior quarter supporting the refinery to draw inventory levels down towards the end of the financial year. South32 realised an ~8% premium to the Platts Alumina Index[26] on a volume weighted M-1 basis for alumina sales in FY22 as we continued to capture the impact of elevated global freight rates in our realised prices (which are also reflected in our Operating unit costs).

BRAZIL ALUMINA (36% SHARE)

Brazil Alumina saleable production decreased by 7% (or 101kt) to 1,297kt in FY22 as the refinery returned to nameplate capacity (3.86Mtpa, 100% basis) from October 2021, following an incident in July 2021 that damaged one of the two bauxite ship unloaders at the operation. Despite the impact of local weather-related disruptions across H2 FY22, the refinery achieved 100% of FY22 production guidance.

Sales increased by 20% in the June 2022 quarter with a carry-over shipment from the prior quarter supporting the refinery to draw inventory levels down towards the end of the financial year. South32 realised a ~5% premium to the Platts Alumina Index on a volume weighted M-1 basis for alumina sales in FY22 as we continued to capture the impact of elevated global freight rates in the realised prices (which are also reflected in its Operating unit costs).

The refinery’s De-bottlenecking Phase Two project was approved for execution in the June 2022 quarter. The project is expected to increase nameplate production rates by approximately 4% to 1.45Mt from H1 FY26, with anticipated capital expenditure of ~US$40M (South32 share) between FY23 and FY25.

BRAZIL ALUMINIUM (40% SHARE)

Brazil Aluminium saleable production was 0.3kt in FY22 with first production achieved in the June 2022 quarter following the successful restart of the smelter. First sales to domestic customers were made in July 2022. With a slower than anticipated ramp-up associated with the need to stabilise the electrolytic bath, South32 expects to provide updated FY23 production guidance with its FY22 results announcement, including revised timing to achieve nameplate production (179ktpa, our 40% share).