Steel production recovers at Cleveland-Cliffs

According to Lourenco Goncalves, CEO of Cleveland-Cliffs, steel production has rebounded alongside the recovery in automotive production. All Big Three US automakers, after its plants were shut down due to COVID-19, are now operating at near full capacity to get back on production schedule and deliver new cars for the holiday season.

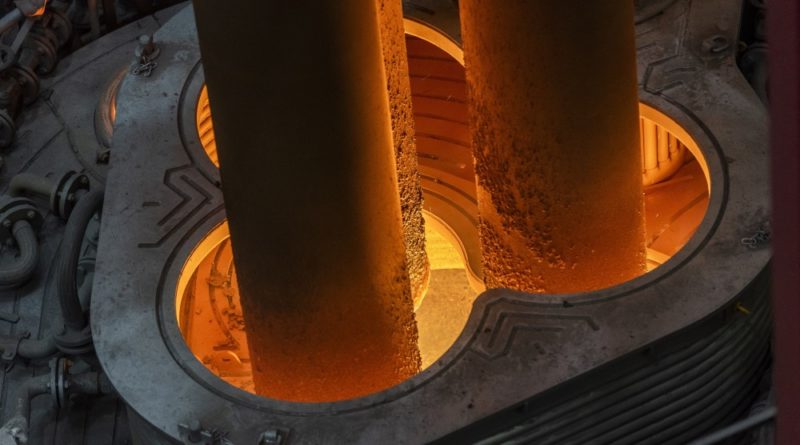

Cleveland-Cliffs is the largest U.S. producer of iron-ore pellets, which are used in the production of steel. If you need proof of the company’s confidence in the steel industry, look no further than its recent move to acquire substantially all of the operations of ArcelorMittal USA LLC and its subsidiaries for approximately $1.4 billion.

Key details:

- “We have been through a very profitable quarter and very strong in terms of the recovery of demand particularly in automotive,” Cleveland-Cliffs CEO Lourenco Goncalves told CNBC.

- “When automotive shut down in this country, we were forced to reduce our output” but “Q3 has been a completely different story,” he said on “Closing Bell.

- Cleveland-Cliffs, the largest U.S. producer of iron ore pellets, announced a $1.4 billion purchase of the U.S. assets of ArcelorMittal SA, the world’s largest steelmaker.

The American economy quickly fell into a recession as businesses closed up and unemployment shot up across the country, but cars demand, much like demand in the housing market, has been one of the unexpected stronger parts in the economic recovery.

Plants of Detroit’s Big Three automaker are now operationg at full speed and deliver new cars to dealerships as the holiday season approaches. SUVs and pickup truck sales have picked up particularly well among the US consumers.

The steelmaking industry suffered its worst downturn sinec the 2008 financial crisis as demand and prices for the product plummeted from the factory closures.

“Cleveland-Cliffs has a massive exposure to automotive and that affected us very seriously during the second quarter,” Goncalves said. “When automotive shut down in this country, we were forced to reduce our output” but “Q3 has been a completely different story.”

North American car production is down 2 million cars from this time last year in part because consumer demand is outpacing the time it takes to get new vehicles from the plants to showrooms, according to Charlie Chesbrough, a senior economist at Cox Auto.