Steel raw materials: volatility continues to prevail

After sliding by USD 10 per tonne since last Thursday, iron ore prices reversed course on 23 March with benchmark physical 62% Australian iron ore fines increasing by USD 4.79 per tonne to USD 161.80 per tonne CFR Qingdao amid higher buying activity by Chinese buyers.

The recent retreat was mainly attributed to the production restrictions in Tangshan in North China’s Hebei province, imposed by the local government to improve the city’s air, which is likely to reduce crude steel production in Tangshan.

STEEL SCRAP

Amid limited interest from Turkish steel mills, imported steel scrap prices remain under pressure with HMS 1/2 80:20 price assessments correcting to USD 415 CFR Turkey. Market reports suggest that with little scrap material needed for April shipment, the Turkish steel mills can afford to wait and their bid indications have dropped to USD 405-410 CFR.

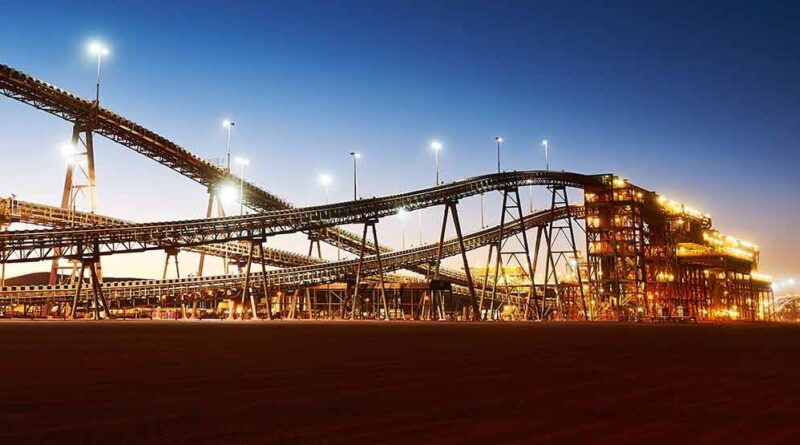

COKING COAL

Coking coal prices corrected further on 23 March 2021 by USD 1.75 per tonne with IHS Markit reducing assessment of Prime Hard Australian Premium Coking Coal to USD 111 per tonne FOB.

IHS Markit said “Asian metallurgical coal prices edged down on Tuesday. In the FOB market, a 162,000 tonne premium low vol Peak Downs cargo for loading in early May was done at USD 111.00 per tone FOB Australia, booked by a European steel mill. A 40,000 tonne cargo of Peak Downs was done at USD 111.00 per tonne FOB Australia, coloading with another 35,000 tonne of Goonyella done at USD 114.00 per tonne FOB Australia for 18-27 April laycan, booked from BHP to an international trader.

In China, United States origin hard coking coal such as Buchanan was offered at around USD 210.00 per tonne CFR China for late April laycan. But demand for seaborne material in China was very limited as steel production cuts continue in Tangshan.”