Tanzania’s graphite project is poised for EV boom

Black Rock Mining, an Australian based emerging graphite flake producer, is moving ahead with its Mahenge graphite flake project in Tanzania, which is supported by a strategic alliance with South Korea’s Posco, Black Rock Mining CEO John de Vries said.

The Mahenge project in Tanzania hosts a multi-generational graphite resource and is one of the largest JORC-compliant flake graphite resources globally, with 212m tonnes at 7.8% total graphitic carbon by loss on ignition (TGC), and a reserve of 70m tonnes at 8.5% TGC.

Black Rock’s Definitive Feasibility Study for the project considers a four-stage construction schedule to deliver up to 340,000 tonnes per annum of 98.5% graphite concentrate for 26 years of 98.5% LOI premium graphite flake concentrate with the ability to produce ultra-purity flake of 99% LOI.

Black Rock is seeking to enter the market at a time of weak prices due to soft demand. The company believes its product mix and reliability means it can be successful when the market recovers and when demand for electric vehicles increases.

Black Rock completed the DFS on the Mahenge Graphite Project in October 2018 and is moving towards securing project financing and progressing into construction and operations with first production targeted in 2021.

The enhanced DFS (eDFS) was undertaken due to strong customer demand and includes a fourth production module which will produce an additional 85,000tonnesof graphite concentrate per year, increasing total steady state production to 350,000 tonnes per year.

The milling schedule in the eDFS was developed using existing pit shells for Ulanzi and Cascades, with no changes in pit inventory or Ore Reserves as an outcome of the eDFS. The additional mill feed in the eDFS will be sourced by developing a third pit at the Epanko deposit.

Epanko ore is exclusively scheduled into Module 4 with production commencing at year seven in the compressed schedule. Epanko contributes 9.9million tonnes (Mt)at 6.7% TGC for an additional 660,000t of concentrate. Epanko feed included 3.4Mt at 8.0% TGC as Indicated Resource, with the remaining material being inferred.

The addition of a fourth production module has no material change to the forecast capex for the first three phases, however will lift the overall revenues with a revised project NPV of US$1.16Bn (an increase of 30% over the original three module DFS).

Total capex for all four modules rises from US$269M to US$337M.The US$222M required to fund modules two, three and four is funded from internal cash flow.

Provision has been made fora 10 MW duel fuel (HFO/diesel) power station for start-up of Module 1.Beyond Module1, the station will be subject to a decision to be used as back-up/standby from year two when grid connection becomes available. Decoupling the overall project from any schedule delays associated with the grid connection reduces schedule risk.

METALLURGY

Historical testwork as well as the proposed Pilot Plant 1 (PP1) flowsheet was reviewed based on CPC experience and it was initially determined that the proposed split flowsheet, whereby larger and finer flakes are classified mid-flotation and processed in separate trains, would result in the highest overall product value.

Subsequent optimisation testwork and piloting in PP1demonstrated that this was not warranted when considering the financial and operability benefits of employing a single flotation-filtration-drying train, and therefore a single train flowsheet was adopted.

The product specification targets are based on marketing feedback and testwork indicated that product graphite grades can be tailored to 95, 97.5 or 99% TGC, by varying the number of stages of polishing and flotation.

The flowsheet to produce 95 and 97.5% TGC concentrates was determined in lab scale optimisation testwork and confirmed in a 40t pilot plant. Samples of the final product exceeding 99%TGC was generated in both sighter lab scale tests and using un-optimised pilot plant scale equipment.

Testwork showed that the graphite particle size distribution (PSD) is generally weighted towards the market-defined coarse product fractions, as opposed to the medium flake product fractions. Good alignment was seen between lab scale PSDs and PP1 PSDs, with P80values regularly above 300μm.

Comminution testwork showed that the ore was relatively soft, however competent with a medium abrasiveness, lending itself to a relatively low energy comminution circuit. No clay issues were identified.

Equipment suppliers were approached to determine technology suitability and design data for a variety of unit operations including, thickeners (Outotec), filters (Outotec), dryers (Drytech) and dry screens (Rotex and Great Western Manufacturing).

Results of the equipment supplier findings include:

•The mill residue thickens well in a high rate thickener and filters well under vacuum in both belt and disc style vacuum filters.

•The concentrate thickens relatively well in a high rate thickener and filters effectively under pressure in a Larox style pressure filter.

•The concentrate can be dried using either a flash or rotary dryer though further investigation is required to determine if conventional flash dryers result in particle burring.

•The dry concentrate was reported to be difficult to screen by Rotex (linear vibrating screen) however an efficient split can be achieved in both instances. Great Western Manufacturing (plansifter) had better results requiring fewer screening units.

Materials handling testwork was undertaken by Jenike & Johanson (J&J) to define mechanical design criteria for solids handling components within the process plant flowsheet. Results showed that the crushed ore exhibits a higher than normal propensity to hold-up and rathole. Chutes and bins have been sized in accordance with the recommendations from the J&J report.

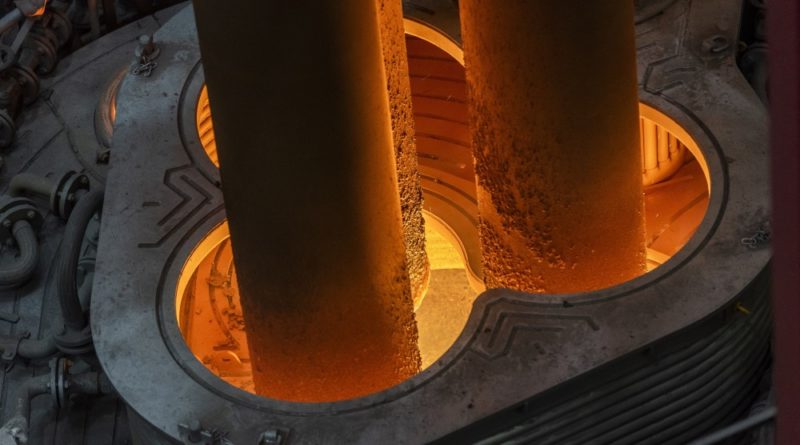

PROCESS PLANT

The Mahenge ore will be processed over theLOM using a four-staged approach which will initially process 1million tonnes per year (Mt/y)in Stage1, increase to 2Mt/y in Stage2,3Mt/y in Stage3and finally process 4Mt/y with the completion of Stage4.

The four stages will be developed over the initial years of the mine with the current mine schedule indicating a LOM of 26years, after which time the current defined deposits will be depleted. Stage1 and Stage2 will process ore predominantly from the Ulanzi and Cascade deposits while Stage3 and Stage4 will process ore predominantly from the Cascade and Epanko deposits.

The Stage1 process plant will be fed ROM ore at an average grade of 8.21% TGC and will recover approximately 93% of this graphite to produce approximately 85,000t of graphite products per year.

The Stage1 process plant has been designed to produce various graphite products targeted at specific graphite end users. Each grade is classified into size fractions relevant to specific graphite end users. The three broad classifications of products have been defined as follows:

- Mahenge Standard Flake–95% LOI

- Mahenge Premium Flake–97.5% LOI

- Mahenge ULTRA PURITY-FP™ Flake–99%+ LOI.

The proposed process plant can be summarised into the following processing stages:

- three stage crushing of ROM

- primary milling in a rod mill and rougher flotation, including a ball mill regrind-scavenger flotation circuit

- primary polishing in a ball mill and three stage cleaner flotation (Ulanzi Standard production)

- secondary polishing in a stirred mill and one stage cleaner flotation

- tertiary polishing in a stirred mill and two stage cleaner flotation (Ulanzi Premium production)

- two stages of ultra-polishing in stirred mills, each followed by one stage cleaner flotation (Ulanzi Ultra production)

- concentrate dewatering using a thickener and pressure filter, followed by a dryer

- product classification using screens

- product bagging

- process plant mill residue is thickened, vacuum filtered and dry stacked.

The process plant is located approximately 600m north of the Ulanzi open pit at an elevation of 487masl. The location for the process plant has been selected in a clearing that is large enough to accommodate the layout for both Stage1 and Stage2 while minimising earthworks. The terrain surrounding the mine is hilly which restricts the suitability of several areas.

The Stage3 and Stage4 process plants will be duplicates of the Stage1/Stage2 process plants and will require the same footprint. The Stage1 layout and equipment selection is duplicated for Stage2.