Tharisa plc: strong demand is evident in the chrome market

Tharisa, the mining, metals, and innovation company says continued strong demand was evident in the chrome market, particularly in the lead up to, these days, a less disruptive Chinese New Year period (official start date 10 February 2024), with demand underpinned by economic fundamentals and continued concerns about inland logistics in South Africa. Freight rates are ticking up on the back of geo-political events impacting maritime shipping routes

The PGM market has continued to suffer from pricing pressure, however, a short-term reprieve towards the end of the quarter, driven by technical short covering, saw some price spikes. The effect of these low prices is evident on the PGM mines in South Africa, with shaft and even mine closures underway. The major pressure on PGM prices remains the (perceived) excess inventory in the PGM pipeline. We expect this to be balanced once the real demand we have seen from end users becomes evident, in particular as further supply cuts are implemented and, on a macro level, policy reduction of subsidies for EV vehicles influences demand.

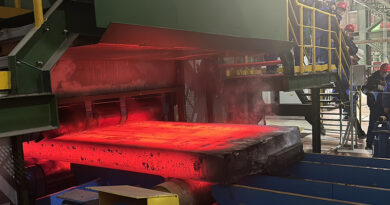

The previously announced review of the commissioning timeline of the Karo Platinum Project remains on track for first ore in mill (FOIM) for June 2025.

Funding solutions ring fenced to Karo Platinum are being pursued in line with the revised production timeline.