Uptick in mining M&A points to a poor pipeline of projects

As more money comes into mining, this will push dollars down to the juniors, said David Garofalo, chair and CEO of GoldRoyalty. Garofalo has a multi-decade career leading large mining companies. He was CEO of Goldcorp prior to its sale to Newmont for about $10 billion in 2019. He was also CEO of Hudbay Minerals.

Garofalo is now at GoldRoyalty, a streaming and royalty company. Some of its key assets are the Odyssey Mine, the Cote gold project and the Borborema project. The company forecasts revenue of about $15 million mid-decade, growing to three times that level by 2029. He said that despite gold hitting several all-time highs this year and copper futures hitting their own record last week, gold equities are still underperforming.

“We’re starting to see profitability and margins starting to expand,” said Garofalo. “But the big overhang for the producer universe is the fact that reserves have been declining steadily for a dozen years. We haven’t seen the leverage to the gold price that equity should be providing.”

Garofalo said broader interest in resources is needed for the sector to be healthy again. He believes a good Q2 performance by the major gold miners resulting from high metal prices and better cost control could see generalists return to the sector.

“I know the juniors are waiting for the seniors,” said Garofalo. “Hopefully [we] see some generalist capital come into the space and buy the most liquid names. If that happens, the specialists who are kind of hiding out among the large caps will start to come down the food chain and start to invest in juniors.

Mining needs more money coming into the sector, he said.

“The specialists have been hiding out because they face significant redemption pressure, so they’ve had to stay in large liquid names,” said Garofalo. “But when generals start coming in and displacing them, then we’ll start to see some risk capital put the work in the juniors. And that’s an existential necessity for the industry.”

Garafalo said the uptick in mining M&A points to a poor pipeline of projects.

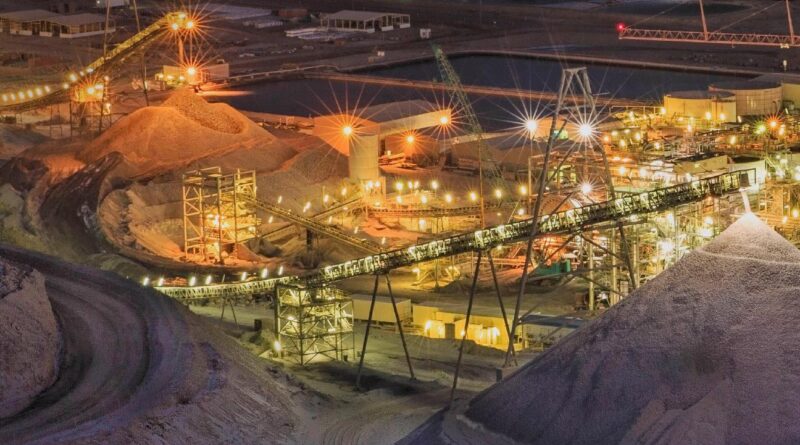

“Juniors have had very inconsistent access to capital, and they’re the ones that do all the heavy lifting when it comes to grassroots exploration,” said Garofalo. “They make the major discoveries. The bigger producers build and operate those mines, but they don’t discover them. And that’s resulted in a 40 percent decline in gold reserves over the last dozen years. So, you have a shrinking pie, and that’s led to cannibalization. That’s led to merger activity.”