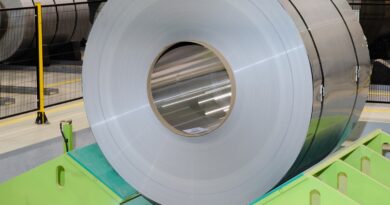

Alumina and bauxite for non-metallurgical applications

The marketplaces for both alumina and bauxite have experienced disruption of supply chains in recent years. Calcined bauxite was primarily sourced from China with Guyana, formerly the main source a distant second and other volumes from Brazil and India.

Chinese production has been restricted because of enforcement of environmental regulations resulting in the closure of many plants until they met environmental requirements or during the winter to reduce air pollution levels.

This restricted supply and caused prices to rise, at a time when demand from the refractories industry was strong. Additional supply from Guyana and to an extent from India and Brazil has been insufficient to replace the lost supply from China.

Alumina supply experienced significant disruption in 2018, with wide fluctuations in spot pricing, although most non-metallurgical trades are based on annual or longer term contracts.

The forced 50% reduction in output from the Alunorte operation in Brazil caused particular tightness in the ATH market in North America, which had become increasingly reliant on imports following the closure of two plants and alternative sources were sought to satisfy demand.

The threat of US sanctions against Rusal and a prolonged strike at some Australian alumina operations also contributed to widely fluctuating spot prices for alumina and restricted supply.

The supply problems are expected to have been largely resolved and outlook will be assessed in the Roskill report.