Which rare earth elements are at risk of substitution?

When considering rare earth permanent magnet applications, the outlook for light and heavy rare earth elements (LREE and HREE) demand shows diverging trends, says Wood Mackenzie.

The LREEs neodymium and praseodymium are the primary forms in which rare earths are consumed in magnets. And although there are some substitution options from other rare earths, such as gadolinium, we expect market availability of neodymium in particular to remain in a constant state of relative tightness.

For HREEs, efforts to reduce exposure to high prices, market volatility and ESG concerns have intensified.

On the other hand, for HREEs, efforts to reduce exposure to high prices, market volatility and ESG concerns have intensified. This is resulting in some OEMs preferring ‘low rare earth’ or ‘no rare earth’ technologies.

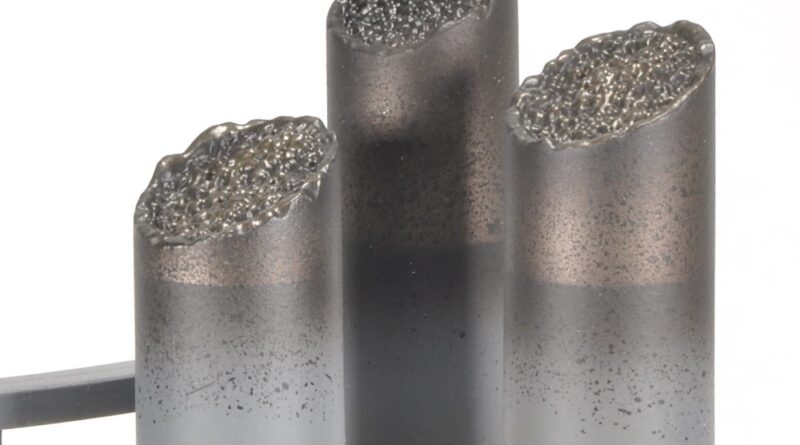

One example is the use of the HREE dysprosium (Dy), vital for use in magnets for high-temperature environments, such as EVs. Grain boundary diffusion has developed as a key technology that allows selective doping with Dy rather than its use as a major alloy component, while maintaining the desired performance. This lowers the overall intensity of Dy use.

How reliant will graphite and lithium supply be on recycling?

Battery recycling typically focuses on the higher-value materials and graphite recycling is, therefore, limited. Graphite will only be recycled if economically viable to do so and, at the moment, there is little interest in recovering it. Importantly, primary graphite deposits are also widely available around the world, which will affect the need for recycling graphite in the longer term.

At the other end of the scale, recycled lithium will need to have a prominent place in the supply landscape long-term. This is due to the rapid demand growth and complexity of production and processing. Currently, the supply from recycled lithium is small, partly due to the lack of end-of-life batteries, but also an immature supply chain.

As the supply chain matures and end-of-life battery availability increases, we expect to see increased supply from the recycled resource stream. If we assume battery life averages around eight years, it will take until the early 2030s before significant quantities of end-of-life cathode material become available.

The quantity will obviously also be affected by improvements in battery life over time, and the potential for used EV batteries to be diverted into the energy storage systems sector.