ArcelorMittal sells its US mills to Cleveland-Cliffs

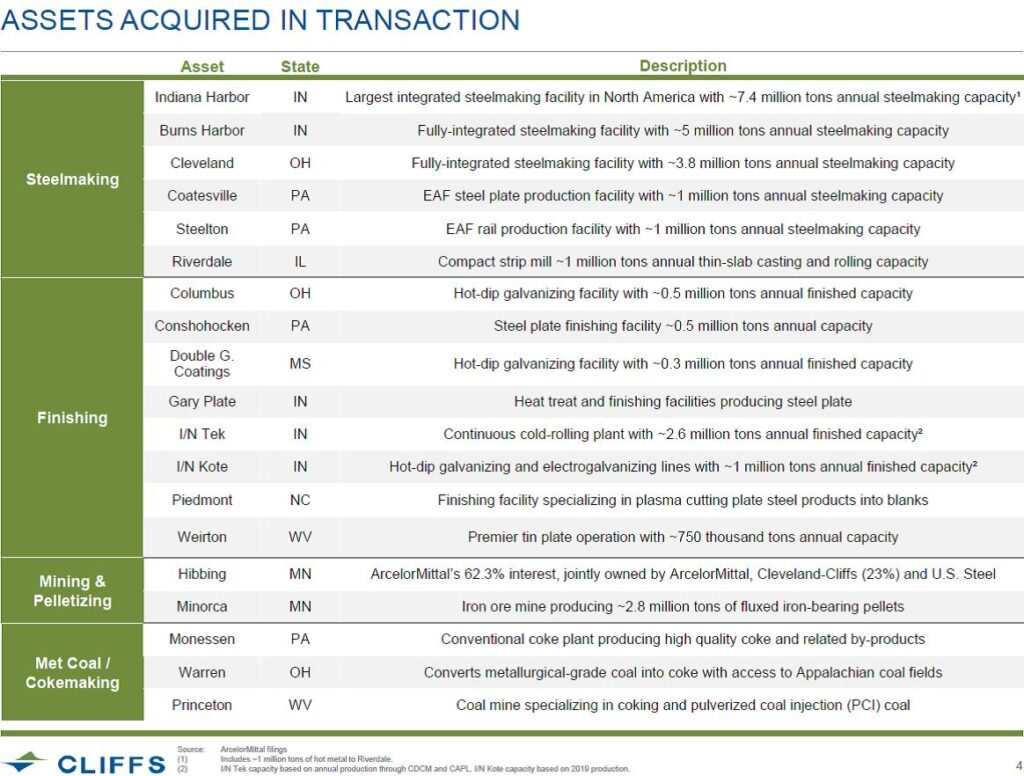

Steelmaker Cleveland-Cliffs Inc. has announced that it has entered into a definitive agreement with ArcelorMittal S.A. to acquire substantially all of the operations of ArcelorMittal USA (AM USA) for approximately $1.4 billion.

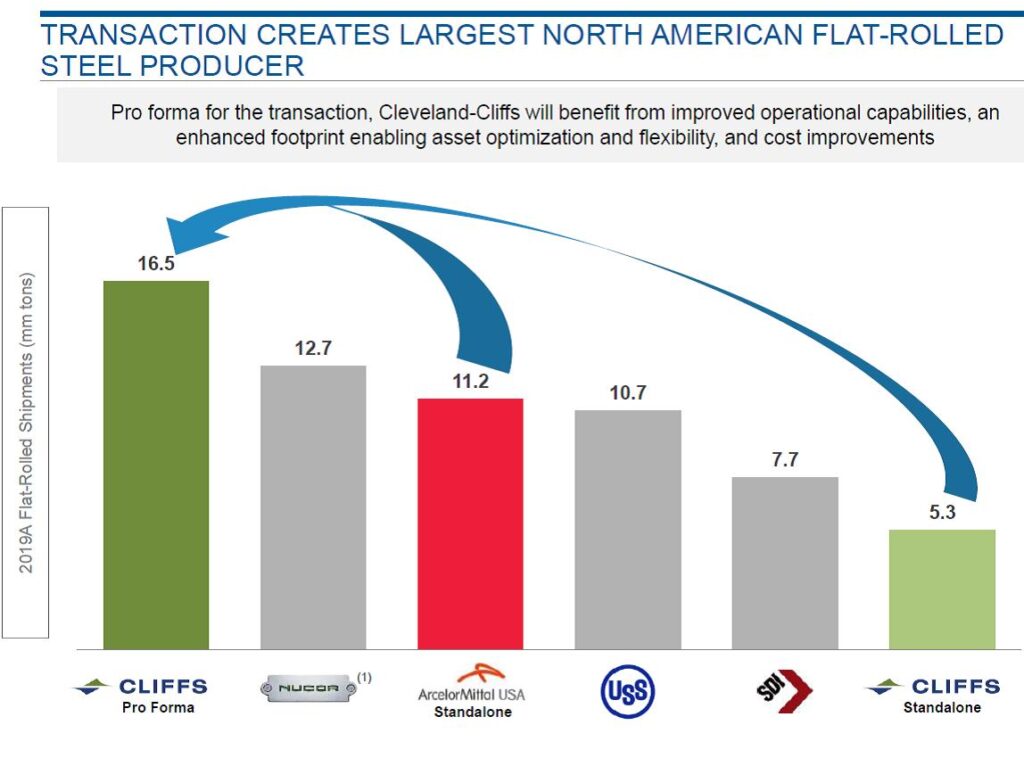

Upon closure of the transaction, Cleveland-Cliffs will be the largest flat-rolled steel producer in North America, with combined shipments of approximately 17 million net tons in 2019. The company will also be the largest iron ore pellet producer in North America, with 28 million long tons of annual capacity.

Cleveland-Cliffs has conduct a live conference call and webcast on Monday, 28 September at 8:30 a.m. ET. The call was broadcast live and archived on Cliffs’ website at www.clevelandcliffs.com.

Transaction creates North America’s largest flat-rolled steel producer with fully-integrated raw material position and focus on value-added steels. Valuation implies equity value of $1.4 billion and a total enterprise value of approximately $3.3billion.

AM USA was acquired on a cash-free and debt-free basis. The deal is expected to close in Q4 2020, subject to the receipt of regulatory approvals and other customary closing conditions. The transaction has been unanimously approved by Cleveland-Cliffs and ArcelorMittal boards.