Sibanye Stillwater SA PGM production increased by 20% during Q3 2021

Sibanye Stillwater recorded another solid operational performance for Q3 2021. Consistent results from the Group operating segments for a second consecutive quarter at pre-pandemic levels, while continuing to adhere to COVID-19 protocols, is a significant achievement.

The SA PGM operations again delivered outstanding results during Q3 2021, with 4E PGM production increasing by 20% and all-in sustaining cost (AISC) declining by 4% year-on-year. This decline in costs is notable in the context of significant inflationary pressures with annual electricity tariffs in South Africa in particular continuing to rise at rates well above inflation.

The consistent operational performance and excellent cost management delivered by the SA PGM operations, has resulted in the SA PGM operations migrating down the industry cost curves. With unit costs at the US PGM operations forecast to decline significantly by 2025 as production from Stillwater East builds up, our relative competitiveness in the global PGM industry expected to continue to improve.

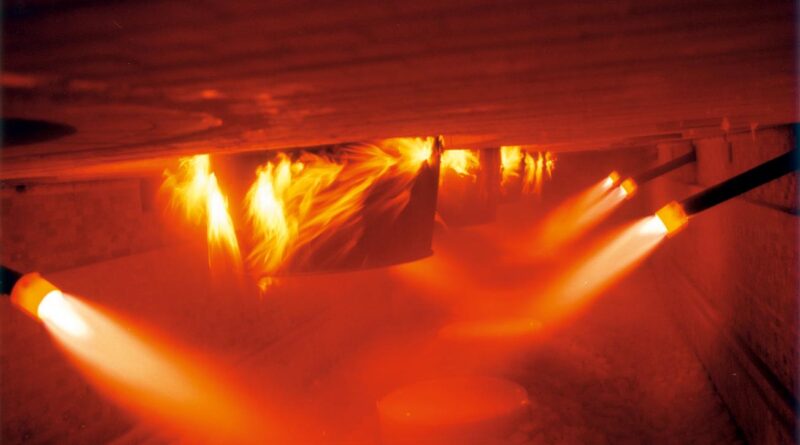

A production shortfall of approximately 40,000 2Eoz is anticipated from the US PGM operations during H2 2021. This is primarily due to the temporary loss of producing blocks at the Stillwater West mine following the imposition of operational restrictions by the Mine Safety and Health Administration (MSHA) after the fatal incident at the Stillwater West mine in June 2021.

Consequently, mined 2E PGM production from the US PGM operations was marginally lower than for the comparable period in 2020, with AISC 11% higher. Cost management is a priority for management at the US PGM operations to counter inflationary cost pressures, and the 6% reduction in AISC for Q3 2021 relative to Q2 2021 is positive.

3E PGM production from the PGM recycling operations was 11% lower than for the comparable period in 2020 as a result of temporary processing disruptions, which have since been resolved with feed rates recovering towards the end of the quarter. The recycling operations continued to benefit from robust PGM prices, in particular for rhodium, resulting in adjusted EBITDA increasing to US$30 million for Q3 2021 compared with US$10 million for Q3 2020.

Production from the SA gold operations was 2% higher than for Q3 2020 reflecting normalisation of operations after the COVID-19 disruptions in 2020, with mined grades returning to planned levels. AISC increased 11% year-on-year due to a higher operating costs associated with the increase in production and carry-over of ore reserve development (ORD) and maintenance capital from 2020. AISC for Q3 2021 was however marginally lower than for the previous quarter and well below average AISC guidance for the year, achieving a positive adjusted EBITDA margin of 19% for the quarter.

Despite the solid operational performance, lower average PGM and gold prices for Q3 2021 resulted in a decline in Group adjusted EBITDA from record levels achieved in previous quarters. Group adjusted EBITDA of R14,877 million (US$1,017 million) for Q3 2021 was 5% lower than for Q3 2020.

PGM prices continued to decrease during Q3 2021 as a result of the ongoing global chip shortage that continues to negatively impact PGM demand in the automobile industry. Prices have since stabilised and Sibanye Stillwater remains confident that the automobile supply chain constraints should start easing during the course of 2022.