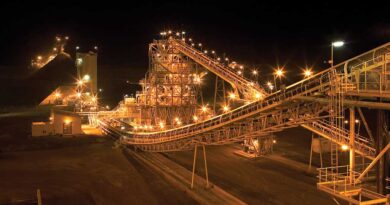

Sustainability focus drives Barrick’s performance

TORONTO — A stronger Q2 performance across the portfolio has kept Barrick on course to achieve its annual gold and copper production guidance while continuing to progress its key growth projects.

Gold production for the quarter was higher than Q1 at 1.04 million ounces — driven mainly by Carlin and Turquoise Ridge in Nevada, Veladero in Argentina, and Bulyanhulu and North Mara in Tanzania — and is expected to grow further in the second half of the year. Copper production came to 120 million pounds.

Operating cash flow was $924 million and free cash flow1 was $169 million for the quarter. Net earnings per share were $0.27 and adjusted net earnings per share2 were $0.24. A dividend of $0.20 per share was declared for the quarter on the back of the strong operating performance and net cash of $636 million.3 During the quarter, Barrick repurchased $182 million in shares under the $1 billion share buy-back scheme introduced earlier this year. It also repatriated the balance of Kibali’s surplus cash from the Democratic Republic of Congo.

In the Dominican Republic, the Pueblo Viejo expansion project advanced with the commencement of the public consultation process and the selection of a preferred site for the new tailings storage facility, subject to the completion of an environmental and social impact assessment. The massive project has the potential to extend the mine’s life to 2040 and beyond with an estimated minimum average annual production of 800,000 ounces.12

In Nevada, the public review period of the Goldrush project has started with the record of decision expected in the first half of 2023, when the production timetable will be confirmed. The definitive agreements underlying the framework agreement between Barrick and the governments of Pakistan and Balochistan on the Reko Diq project are being finalized. Once this process has been completed and the necessary legalization steps have been taken, Barrick will update its feasibility study on what is one of world’s largest undeveloped copper-gold deposits, with first production expected in 2027/2028.

Barrick is continuing to expand its global exploration footprint with a strengthened team. In North America the search has extended from Nevada to active projects in Canada. The intensified exploration drive in Latin America led to an entry into the Guiana Shield, and in Africa & the Middle East, new projects have been initiated in Zambia, Tanzania and Egypt. A new Asia Pacific team is making progress at Reko Diq, as well as Japan, while also looking for fresh opportunities elsewhere in this region.

Reviewing the quarter, president and chief executive Mark Bristow said the critical scrutiny of ESG and sustainability disclosures was intensifying in a climate of skepticism about so-called greenwashing. Against this background, Barrick’s annual Sustainability Scorecard, an industry first, continues to report the group’s performance transparently and objectively against a wide range of standard metrics.

“We’ve taken the leadership in integrating the various aspects of ESG and managing these complex issues in a measured and holistic manner,” he said.

“There are challenging times ahead, but Barrick faces them with strong and agile leadership, a robust balance sheet, solid Life of Mine plans, a reliable cash flow and a strategy focused on sustainability and value creation.”

Best Assets Indicators

- Stronger Q2 performance across the portfolio keeps Barrick on track to achieve 2022 production targets

- Goldrush Notice of Availability published in Federal Register starting the public comment period

- Significant progress made with the Pueblo Viejo expansion project and additional tailings storage facility

- Copper portfolio delivers with growing prospectivity

- Continued focus on brownfields and greenfields exploration, driven by energized new leadership, delivers results