Positive outlook for Renisin Tin despite a challenging year

Metals X have released their latest report from the final quarter of 2022, highlighting some continued processing issues in the second half of the year.

The company has been tackling high grades of talc in the ore since Q3, impacting the operations at the mill. Grades and recoveries both continued to decline in Q4, albeit marginally. However, this was offset by increasing throughput at the mine. Overall, the company produced 1,925 tonnes of tin, up 4.2% from the previous quarter.

With the increase in tin production, cash production costs were lower. Production costs per tonne were roughly AU$ 19,841 (US$ 13,044), a decrease of 6% from the previous quarter, and well below the LME benchmark tin price.

All-in sustaining costs did rise marginally however, as payments for major works, including increasing tailings capacity, were required.

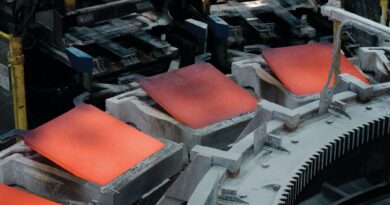

The company shipped some 1,209 tonnes of tin-in-concentrate to major smelters MSC, Thaisarco, and YTC during the quarter. This was up 50% from the third quarter of 2022. The realised tin price – some AU$ 28,307 – was down nearly 7.5%, reducing imputed revenue.

The company also provided an update to the Rentails project. The company has completed the first stage of the Rentails Definitive Feasibility Study Update, with an updated 2023 study plan for the project also approved.

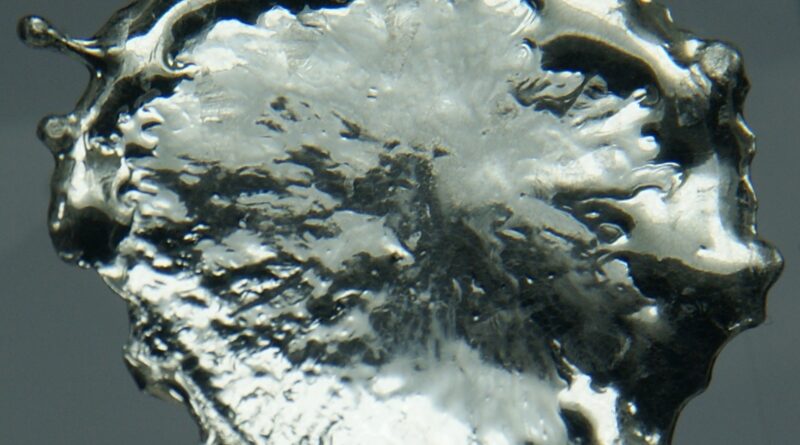

The main objective of the updated plan is to complete the Thermal Upgrade Plant Furnace Technology selection. Trials are being conducted to test the metallurgical performance of both Box fumer and Ausmelt Top Submerged Lance technologies. Tin recoveries, quality of the final product, fuel consumption, fluxing requirements and furnace capacity will all be verified and followed up by a technoeconomic assessment to select the best technology for the tailings project.

Although it has been a challenging year, with COVID disruption leading into processing issues, things are looking positive for Metals X in the new year. External consultants are now working on trials to identify the most appropriate methods of dealing with the high talc grades. If resolved this will increase grades and recoveries to prior baselines.

A lot of progress was also made on the Area 5 Upgrade in the fourth quarter, which on completion will lead to higher grade material being processed.

With the addition of higher-grade stopes from Leatherwoods later on in the year, costs are budgeted to continue falling.