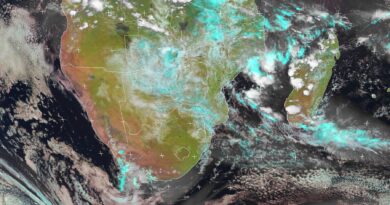

2023 outlook: Platinum supply restricted by electricity shortages in SA

Whil

The forecast deficit for 2023 (-556 koz) is deeper than projected in Q3’22 Platinum Quarterly, primarily on the identification of additional planned glass capacity expansions in China during 2023.

Mining supply is expected to continue to be restricted by electricity shortages in South Africa and sanctions-related operational challenges in Russia. A significant challenge facing the South African mining industry is the ongoing electricity crisis.

st the miners have been able to flex operations to accommodate power shortages without significantly impacting output to date, it creates uncertainty regarding the release of semi-finished inventory built up during smelter maintenance.

Recycling supply chain constraints experienced in 2022 are expected to abate in 2023 although the macro-driven reduced availability of end-of-life vehicles will keep recycling supply well below pre-COVID levels.

Strong demand growth is still expected as automotive demand is driven by rising platinum substitution for palladium, which offsets reductions from growing EV penetration and still muted new vehicle production.

Whilst jewellery demand is anticipated to remain weak, industrial demand strength, led by glass capacity expansions, is forecast to continue. This strong growth in industrial demand

is driven by significant glass capacity additions in China, with global platinum demand from the glass sector expected to grow by 55% year-on-year to 737 koz. It is worth noting the high variability in growth of industrial demand for platinum is strongly linked to capacity additions rather than annual replacement for wear. Similarly, investment demand is expected to improve significantly in 2023. Despite the muted start to 2023, platinum bar and coin demand is projected to increase by 100% year-on-year to 450 koz.

ETF demand is expected to improve from net outflows of -560 koz in 2022 to -132 koz in 2023. Exchange stock outflows are also expected to moderate from -307 koz in 2022 to -20 koz in 2023. The net impact is for investment demand to move -643 koz in 2022 to +298 koz in 2023 a change of over 900 koz versus 2022.

Total platinum demand in 2023 is forecast to increase year-on-year by 24% (1,534 koz) to 7,985 koz. In combination with the muted supply outlook, the net impact is for a project platinum market deficit of 556 koz in 2023, a change of more than 1.3 Moz from the

surplus in 2022.