Alphamin Resources benefits from 25% higher tin price

MAURITIUS – Alphamin Resources, a producer of 4% of the world’s mined tin from its high gradeoperation in the Democratic Republic of Congo, has provide the following operational and growth update for the quarter ended March 2021:

- Q1 EBITDA guidance of $36,5m, which would be a new quarterly record, at a tin price of $23,083/t (Current: ~$25,000/t);

- Tin sales of 3,351 tons, up 45% from the previous quarter;

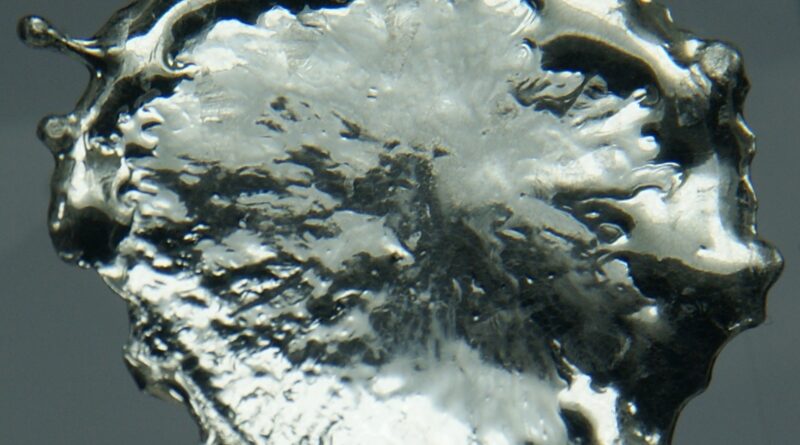

- Main Zone mineralisation intercepted at Mpama South, based on visual inspection and interpretation, is comparable to the Resource mined at the high grade Mpama North Mine;

- New parallel mineralisation zone discovered in the footwall of the Main Zone at Mpama South;

- Fine tin recovery plant on schedule for commissioning during June 2021

Contained tin sales of 3,351 tons was 45% higher than the previous quarter as we recouped the sales shortfall of Q4 2020. Contained tin production of 2,611 tons was impacted by a lower feed grade of 3.8% Sn compared to 4.2% Sn the previous quarter.

Tin feed grades are variable between quarters but on average trend close to the targeted 4% Sn Reserve Grade over a rolling 12-month period. The processing plant performed well at an average recovery of 74% whilst treating more material than the previous quarter.

Our EBITDA guidance of $36,5m for Q1 2021 is 118% above the previous quarter due to increased sales volumes benefiting from a 25% higher tin price. Tin prices are currently trading at around $25,000/t, some 10% above prices achieved during the past quarter.

The Fine Tin Recovery Plant (FTP) is on schedule for full commissioning during June 2021. Estimated expenditure at completion is substantially in line with the budget of US$4.6 million. The FTP has the potential to increase contained tin production by 5%-10% effective July 2021.