AMSA blames high prices of raw materials on its weaker performance

VANDERBIJLPARK – Based on information currently available, ArcelorMittal South Africa has advised that the Company expects the earnings per share to decline from R5,94 profit per share for the comparative period to a profit within a range of R2,20 and R2,50 per share for the period (representing a decrease of between 58% and 63%) as well as the headline earnings per share to decline from R6,15 headline profit per share for the comparative period to a headline profit per share within a range of R2,15 and R2,45 per share for the period (representing a decrease of between 60% and 65%).

On 28 July 2022, at the announcement of the Company’s six-months financial results, it was indicated that the outlook for the coming six months was strongly influenced by intensified economic headwinds which threatened to significantly affect the trading environment for steel.

As anticipated, the international price correction in a soft local demand environment did significantly impact the financial results of the business.

Globally, steel prices have declined at a faster rate than raw materials. This has led to negative price-cost effects with spreads (i.e. the difference between steel prices and raw material costs) under significant pressure.

The company could not escape the impact of the year’s energy crunch, as seen in the extreme increase of imported coal prices (up 117% year-on-year).

Domestically, market conditions proved to be especially challenging as customers aggressively destocked. This was particularly notable in the last quarter of the year, where market activity dissipated dramatically in certain sectors (being somewhat reminiscent of late-2008).

The business is responding effectively, through among other things, its Value Plan and fixed cost resizing. Thus, despite the sharp weakness which characterised the second half of the year, the financial results are significantly stronger than during other crisis or near-crisis environments of the past.

An aspect of the business which unexpectedly came under significantly more pressure than initially anticipated, was the net borrowing position. Having successfully improved average capacity utilisation in the second half (54%) compared to the first half (42%) of the year, the suddenness of slowdown in market activity in the latter part of the fourth quarter was greatly aggravated by a notable shortage of readily available road trucks for sales deliveries.

The well-publicised rail logistic failures on the country’s coal export rail corridors, and the very attractive prices offered for that product, resulted in a dramatic and unexpected shortage of road trucks for domestic and Africa overland deliveries in the last quarter of the year.

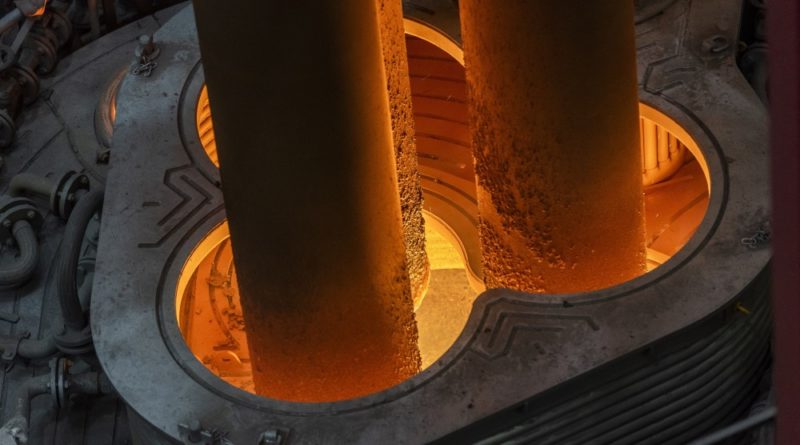

Considerable time, resources and capital investment have been invested in physical infrastructure to improve safety, and environmental compliance.