Anglo American reports copper production down for 2022

Anglo American has reported the impact of adverse weather and planned lower grades at many of its operations contributed to a 2% production decrease on a copper equivalent basis in 2022.

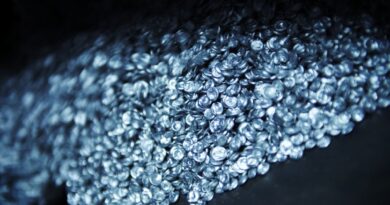

The company said that De Beers’ rough diamond production increased by 7% to 34.6 million carats (2021: 32.3 million carats); total copper production of 664,500 tonnes increased by 3% (2021: 647,200 tonnes); nickel production decreased by 5% to 39,800 tonnes (2021: 41,700 tonnes); total PGM production decreased by 6% to 4,024,000 ounces (2021: 4,298,700 ounces); iron ore production decreased by 7% to 59.3 Mt (2021: 63.8 Mt); steelmaking coal production was in line with the prior year at 15.0 Mt (2021: 14.9 Mt); and manganese ore production was in line with the prior period at 3.7 Mt (2021: 3.7 Mt).

“Extreme rainfall in Brazil, South Africa and Australia affected iron ore production at Minas-Rio and Kumba, steelmaking coal production at Capcoal and Dawson, and nickel production at Barro Alto. First copper concentrate production from our newly commissioned Quellaveco copper mine in Peru more than offset lower production at our copper operations in Chile that were due to planned lower grades at Los Bronces and Collahuasi,” Anglo American said in a press release.

“Lower grades also impacted production at Mogalakwena (PGMs) and Barro Alto (Nickel). The planned end of mining at the Grasstree steelmaking coal operation was partially offset by the ramp-up of the replacement Aquila longwall. De Beers increased production in line with continued strong demand for rough diamonds,” it added.

Anglo American’s profit attributable to equity shareholders decreased to $4.5 billion in 2022 (2021: $8.6 billion). Underlying earnings were $6.0 billion (2021: $8.9 billion), while operating profit was $9.2 billion (2021: $17.6 billion).

The company said that Group underlying earnings decreased to $6.0 billion (2021: $8.9 billion), driven by the lower underlying EBITDA, partly offset by a corresponding decrease in income tax expense and earnings attributable to non‑controlling interests.

Group underlying EBITDA decreased by $6.1 billion to $14.5 billion (2021: $20.6 billion) due to a decrease in the price for the Group’s basket of products, lower sales volumes and higher input costs across the Group.

“As a result, the Group Mining EBITDA margin of 47% was lower than the prior year (2021: 56%),” the company noted.

Importantly, the company announced that in line with the Group’s established dividend policy to pay out 40% of underlying earnings, its Board has proposed a final dividend of $0.74 per share (2021: $1.18 ordinary dividend per share and $0.50 special dividend per share), equivalent to $0.9 billion (2021: $2.1 billion including special dividend).

Looking ahead, CEO Duncan Wanblad said, “The fundamental demand picture for future-enabling metals and minerals – particularly those that are responsibly sourced with traceable provenance – is ever more compelling. Our new Quellaveco copper operation in Peru increases our global production base by 10% and is the cornerstone of our value-adding growth potential of 25% over the next decade, with further optionality beyond, from copper to crop nutrients.

“As most of the world’s major economies accelerate their decarbonisation efforts and as the global population increases and continues to urbanise, we aim to keep growing the value of our business into that demand.” Anglo American is a leading global mining company producing diamonds (through De Beers), copper, platinum group metals, premium quality iron ore and steelmaking coal, and nickel – with crop nutrients in development. The company is committed to being carbon neutral across its operations by 2040.