Barrick gold set up for strong 2021 finish

London – Strong third-quarter production from Barrick Gold’s Africa and Middle East and Latin America regions has positioned them to meet the top end of their guidance for the year. At the same time, Nevada Gold Mines posted a quarter-on-quarter improvement and, with its Carlin mill operations now restored, is set to end 2021 with an enhanced quarter, positioning Barrick for a strong finish to the year.

The company’s Q3 results report attributable gold production for the quarter of 1.09 million ounces and 3.23 million ounces for the year to date. Attributable copper production for the quarter was 100 million pounds and 289 million pounds for the year to date.

Presenting the results, president and chief executive Mark Bristow said the operating cash flow of $1,050 million and the free cash flow2 of $481 million for Q3 would further support an already strong balance sheet and the funding of Barrick’s capital allocation priorities.

He noted that the sustainable quarterly dividend of 9 cents per share and the payment of the final $250 million3 tranche of the $750 million return of capital distribution would combine to lift the total cash return to shareholders to a record level of approximately $1.4 billion during 2021.

“More than two years after the merger, we are getting to where we want to be, with the industry’s best asset base in the form of six Tier One13 gold mines and a well-balanced portfolio of high-quality growth opportunities. In Nevada, the publication of an official Notice of Intent marks another advance in the development of the world-class Goldrush project, where the successful processing of the first bulk samples points to an additional reserve conversion by the end of the year,” he said.

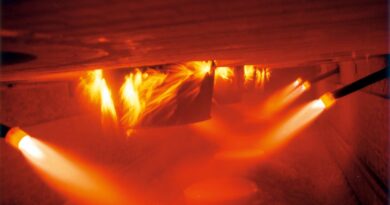

“In Argentina, the commissioning of the new heap leach facility at Veladero, defined as an at-risk asset at the time of the merger, has put the mine back on track to get back to its past performance as it ramps up production. In Tanzania, we have completely revived the moribund Bulyanhulu mine and it too is now back in business and ramping up production. In Alaska, the 2021 drilling program has been completed at Donlin, one of the largest undeveloped gold deposits in the world, and we’re now updating our models and preparing for an early start to the next phase.”

The Pueblo Viejo expansion project in the Dominican Republic is at the permitting stage for the new tailings storage facility. The project is expected to extend the Tier One mine’s life beyond 2040 and has the potential to convert approximately 9 million ounces of measured and indicated resources to proven and probable reserves.

Bristow said results from successful brownfields exploration, particularly in North America and Africa, indicated that the group is on track to replace its gold reserves net of depletion in 2021. The drive to expand its portfolio and extend its global footprint has added new exploration projects in five countries.

Barrick has also been advancing its greenhouse gas (GHG) reduction strategy with NGM starting construction of its solar power plant with an initial capacity of 100MW and the permit received to double this to 200MW, and Veladero completing construction of its cross-border link-up with the Chilean national power grid — a global leader in renewable energy.

“Barrick is driven by value creation and by any measure we’ve been successful so far. But ours is a long-term vision which looks far beyond our major operations’ current 10-year business plans and our ceaseless pursuit of new opportunities is continuing to deliver exciting future prospects,” Bristow said.