Barrick is on track to achieve full-year production targets

Barrick Gold Corporation has reported preliminary second-quarter sales of 1.22 million ounces of gold and 123 million pounds of copper, as well as preliminary second-quarter production of 1.15 million ounces of gold and 120 million pounds of copper.

Group gold production for the first six months of 2020 was 2.4 million ounces, at the midpoint of the Company’s 4.6 to 5.0 million ounce guided range for the year.

President and chief executive Mark Bristow said these results positioned Barrick well to achieve its guidance for the year, despite the impact of the global Covid-19 pandemic and the resultant lockdowns1.

Comprehensive programs to counter the spread of Covid-19 are in place at all of Barrick’s operations and it continues to take the necessary steps to manage the impact of the pandemic on its business.

The average market price for gold in the second quarter was $1,711 per ounce, while the average market price for copper in the second quarter was $2.43 per pound.

Preliminary second-quarter gold production was, as previously guided, lower than the first quarter of 2020. This was mainly due to the impact of Covid-19 at Veladero in Argentina where quarantine restrictions were lifted in April and movement and social distancing restrictions slowed the remobilization of employees and contractors back to site, a planned maintenance shutdown at Pueblo Viejo in the Dominican Republic and reduced production at Porgera in Papua New Guinea as the mine was placed on care and maintenance on April 24, 2020.

Preliminary second quarter gold sales were in line with the previous quarter, and were higher than production in the second quarter following the start of exports of concentrate stockpiled in Tanzania.

Second quarter gold cost of sales per ounce2 are expected to be 4-6% higher, total cash costs per ounce are expected to be 2-4% higher and gold all-in sustaining costs per ounce3 are expected to be 7-9% higher, respectively, than the first quarter of 2020.

Preliminary second quarter copper production and sales were both higher than the previous quarter. Second quarter copper cost of sales per pound are expected to be 5-7% higher than the prior quarter.

C1 cash costs per pound are expected to be in line and copper all-in sustaining costs per pound3 are expected to be 4-6% higher, respectively, than the first quarter of 2020.

Barrick will provide additional discussion and analysis regarding its second quarter production and sales when the Company reports its quarterly results before North American markets open on August 10, 2020.

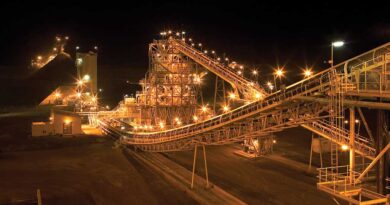

Barrick Gold Corporation is the second-largest gold mining company in the world, after Newmont Corporation. Headquartered in Toronto, Ontario. Barrick has gold and copper mining operations and projects in 13 countries in North and South America, Africa, Papua New Guinea, and Saudi Arabia.