Bokoni PGM operation complements ARM’s current PGM portfolio

The ARM’ Bokoni mine transaction represents an opportunity for ARM to acquire a significant South African PGM operation that complements ARM’s current PGM portfolio. BPM is a natural strategic fit with ARM’s current PGM portfolio based on the Eastern Limb of the Bushveld Complex in Limpopo.

The Transaction will facilitate growing and enhancing the competitiveness of ARM’s PGM portfolio and position ARM as a significant global primary producer of PGMs. A new mine plan has been developed for BPM and will focus predominantly on mining the UG2 resource, employing fully mechanised mining methods and target predominantly on-reef development.

This plan targets better ground conditions and higher-grade mining areas, while fully leveraging existing mining and processing infrastructure. ARM expects that its new mine plan will improve efficiencies, reduce unit costs and provide early revenue. ARM will concurrently evaluate the opportunity of mining the Merensky reef whilst developing the UG2 mine to capitalise on the current strong PGM basket prices.

Interim period undertakings in the Transaction agreements, subject to applicable laws, will facilitate ARM expediting its progress of the Definitive Feasibility Study (”DFS”) for BPM. The DFS is expected to be completed in approximately 12 months from the Signature Date of the Transaction.

ARM’s proposed DFS will exploit BPM’s high-grade resource and its potential for a fully mechanised mining method. The combination of high labour productivity obtained from a mechanised mining operation and high reserve grades is expected to result in low unit cash costs per PGM ounce for BPM.

ARM’s focus for the next 12 months will be to finalise a DFS and in parallel obtain all mining approvals. This will enable ARM to commence mining operations in 2023. ARM’s planned DFS envisages the following technical and operational parameters:

- Approximately R5.3 billion of development capital in real 2021 terms to be spent over 3 years;

- Targeted steady state operational cost of less than R12 000 per 6E ounce (in 2021 terms);

- Mechanised on-reef mining method utilising existing proven technologies;

- Steady state production target date of 2028;

- Steady state production of approximately 300 000 ounces of 6E PGM contained in concentrate per annum;

- Steady state production of approximately 255 000 tonnes of chromite concentrate per annum; and

- Utilising state of the art training facilities to upskill and maximise local employment potential.

The Transaction includes several compelling characteristics for ARM including:

- Long-life orebody favourably impacting medium term production

- adding a long-life operation greater than 24 years with significant opportunity for further value accretive growth;

- increases ARM’s medium-term attributable production, by approximately 300 000 ounces of 6E PGM production per annum and 255 000 tonnes of chrome concentrate per annum at steady state; and

- positions ARM as a significant global primary PGM producer targeting in excess of 1.2 million 6E PGM ounces (on a 100% basis) and 650 000 6E PGM ounces (on an attributable basis) by 2026.

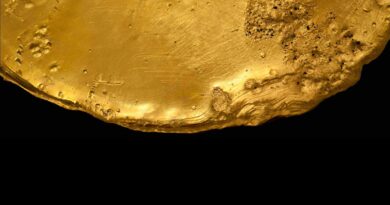

Sector leading UG2 resource base

- enhances the size and quality of ARM’s PGM resource base by 153 million 4E PGM ounces;

- provides exposure to a high-grade UG2 resource that has an attractive prill split with high concentration of palladium and rhodium and favourable iridium and ruthenium contributions;

- containing a UG2 resource grade of 6.6 4E g/t which is amongst the highest in South Africa; and

- containing a UG2 resource with high nickel and copper grades of 0.17% and 0.05% respectively.

Improve ARM’s portfolio mix

- improves ARM’s portfolio mix and competitiveness, with the addition of a fully mechanised underground operation that is expected to lower ARM’s overall PGM cost curve position;

- ARM’s new mine plan is expected to position BPM in the bottom half of the PGM cost curve;

- supports a relatively shallow mine to a maximum depth of 600m below surface;

- provides for potential scale benefits and opportunities for operational optimisation, given its proximity to ARM’s other Eastern Limb PGM operations; and

- allows ARM to manage, operate and control an additional PGM asset which allows ARM to evaluate value accretive strategic options within ARM’s PGM portfolio; and

- improves ARM Platinum’s total combined mineral resource grade by 0.8g/t to 5.3g/t

ARM’s new mine plan should position BPM for sustained earnings and cashflow generation over the medium to long term.