China and DRC maintain dominance in global cobalt supply chain

According to Fitch Solutions, the global cobalt industry is set to receive a significant boost from the worldwide shift to a green economy, as the ferromagnetic blue metal is a key component of rechargeable batteries and valued for its stability, hardness, anti-corrosion and high-temperature resistance characteristics.

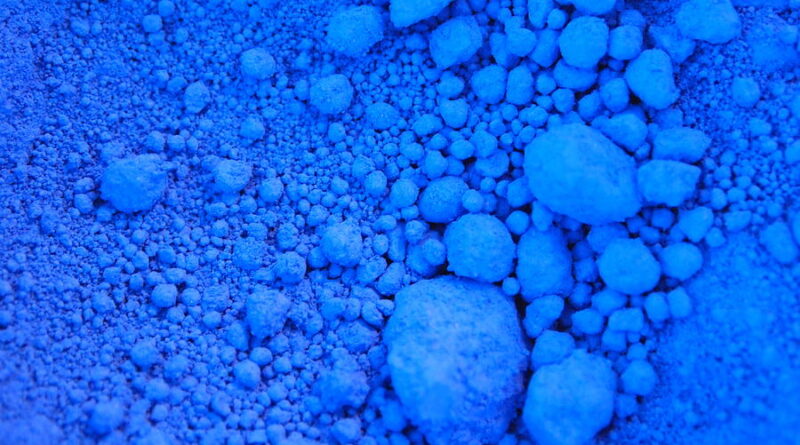

Used traditionally as a pigment, due to its luminous blue colour, the metal’s main use today is in the precursors and cathodes of rechargeable batteries (56% of total consumption as of 2021). Employing cobalt as the cathode of rechargeable batteries efficiently improves their energy density, power, and performance as compared to batteries that lack cobalt.

Cobalt is also used in the manufacturing of nickel‑based alloys (13% of total consumption) which are used extensively in the aerospace industry, tool manufacturing (8% of total consumption) and finally smaller amounts in pigments, soaps and as catalysts.

The end use of cobalt is primarily in portable electronics (36.3% of global consumption), such as smartphones and laptops, while automotive applications also account for a major share (23%) and we expect the latter to drive cobalt demand in the coming decades.

Cobalt is recovered mainly as a by-product of copper and nickel mining, with its availability dependent on the ongoing mining of its host metals. Stratiform sediment-hosted copper-cobalt deposits (mostly in the DRC and Zambia) represent the world’s largest source of cobalt, followed by nickel-cobalt laterite deposits (mainly found in Australia, Cuba, New Caledonia, Madagascar, Papua New Guinea, and the Philippines) and lastly magmatic nickel-copper-cobalt-PGM deposits (mainly Canada, Russia and South Africa).

While cobalt-rich crusts on the ocean floor could contain as much as 1bnt of cobalt resources, deep-sea mining is still in its infancy given obvious technological and economic constraints.

The cobalt industry is highly geographically concentrated mine production wise, with a single country, the Democratic Republic of Congo (DRC), accounting for 67% of the global supply in 2020, and we expect this dynamic to continue over the coming decades.

Cobalt refining is also highly concentrated in a single country, China, which will broadly remain the case. There are new cobalt refining projects underway globally which will work to reduce China’s market share to a limited extent. China accounts for 66% of global refined cobalt output, followed by Finland (10%). Both countries rely on imported feedstock from the DRC for their refining operations.