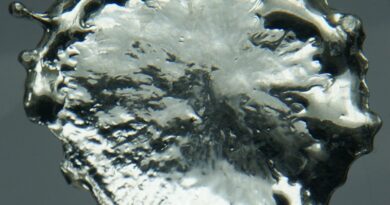

China’s refined nickel output up by 8.12% MoM by down 5.51% YoY

China produced 12,900 mt of refined nickel in February, up 8.12% MoM and down 5.51% YoY. The decline in output was mainly due to less calendar days in February. In addition, some manufacturers carried out maintenance during this period.

The output of refined nickel is expected to stand at 12,700 mt in March 2022. The output is likely to drop 1.5 MoM and 2.5% YoY. The output in March may stand below the normal level as the pure nickel plants in Xiajiang have maintenance plans.

NICKEL SULPHATE

China’s output of nickel sulphate stood at 25,000 mt in metal content, or 113,800 mt in physical content in February, down 4.08% MoM but up 66.0% YoY. In February, due to the combined effects of fewer natural days, longer holidays, and poor profits that forced some nickel salt factories to reduce the production, the output fell significantly.

From the structure of raw materials, the proportions of nickel briquette and nickel powder declined significantly due to poor cost efficiency, and the proportion dropped to 42%. Some companies said that according to the current nickel prices, they would stop using nickel briquette from March and suspend the operation of dissolution lines.

The proportion of MHP and scrap increased, and the proportion of MHP rose to 36% in February. Macro sentiment fluctuations, coupled with capital disturbances, have sent nickel prices to new highs constantly in early March. For nickel sulphate, the pressure from the raw material side surged amid expanding SHFE-LME spread.

The production in March will face greater uncertainties. The output of nickel sulphate is expected to stand at 26,000 mt in Ni content in March, up 4.3% MoM and 20.5% YoY. Concerns about the supply of raw materials have increased, and the production of enterprises is scheduled based on market situation.

NPI

Domestic NPI output stood at 32,600 mt in Ni content in February, up 2.8% MoM and down 13.9% YoY, according to SMM research. Among them, the output of high-grade and low-grade was 26,800 mt and 5,800 mt respectively.

The month-on-month decline was mainly due to the reduction in natural days and environmental protection-related production restrictions in February, and the plants in north China were more seriously affected. Among them, Shandong, Inner Mongolia, Liaoning and Hebei all saw reduced output. The decline of low-grade NPI output was also owing to the maintenance of integrated stainless steel mills.

Domestic NPI output in March is expected to rise 2.76% month on month to 39,500 mt in Ni content. And the output of high-grade and low-grade NPI is likely to stand at 32,600 mt and 7,000 mt in Ni content respectively. An output increase could be expected in March mainly due to the resumption of production. However, in light of limited nickel ore inventory, it is difficult for the output to increase significantly.