Chinese Alumina and aluminium record decreases

According to the local authorities, China alumina output in February (28 calendar days) was 5.47 million mt, of which metallurgical-grade alumina output stood at 5.27 million mt, according to SMM statistics. The average daily output of metallurgical-grade alumina stood at 188,000 mt, a decrease of 16.15% MoM and 6.74% YoY.

The roasting capacity of alumina refineries in Shandong were unchanged, while those in Shanxi and Henan were a totally different story. Among them, the output in Shanxi dropped by 21% month-on-month, and by 32% in Henan. The production of two alumina refineries in Guangxi was restricted due to the COVID pandemic, and the output in Guangxi fell 24% month-on-month.

It is estimated that the net imports of alumina stood at 150,000 mt, and there was a shortage of 255,000 mt in the month. However, with the release of new alumina capacity in March and the rapid recovery of existing capacity, this shortfall will be quickly filled. Alumina supply and demand will return to the tight balance. (1 mt of aluminium consumes 1.925 mt of alumina).

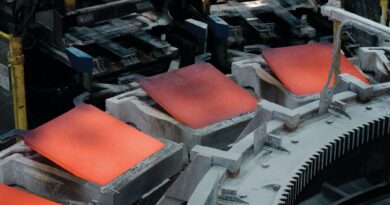

ALUMINIUM

China produced 2.95 million mt of aluminium in February (28 days), down 2.35% on the year. The daily output averaged 105,000 mt, up 1,900 mt/day on the month. The output totalled 6.15 million mt from January to February, a decrease of 3% on the year.

On the supply side, more aluminium smelters resumed the production or put new capacities into production in February. Among them, the operating aluminium capacity in Yunnan rose significantly amid support from the government and China Southern Power Grid.

Throughout the month, a combined capacity of 740,000 mt was resumed or newly put into produciton in Yunnan. Inner Mongolia, Guizhou, Shanxi, and Guangxi steadily resumed the production in February with a total capacity of 276,000 mt.

The outbreak of COVID pandemic in Guangxi caused an emergency shutdown of 420,000 mt capacity of an enterprise in Tianyang city. As of early March, the domestic operating aluminium capacity reached 38.98 million mt, with the valid installed capacity at 44.52 million mt, hence the average operating rate stood at 87.5%. The downstream sectors of aluminium liquid saw lower operating rates in February due to the Chinese New Year holiday, and the proportion of liquid in the entire product portfolio dropped 3.1 percentage points to 61.1%.

The domestic supply side has been rising steadily entering March, of which Yunnan is expected to contribute another 440,000 mt of operating capacity (including new capacity being put into production). New capacities and resumption of production in other regions is estimated at 120,000 m.

With the steady growth of the average daily output in March, the output of aluminium is expected to reach about 3.3 million mt. On the demand side, the current aluminium downstream is in seasonal recovery, and the social inventory of aluminium ingot is expected to fall in mid-March, and reach 1.15 million mt by end of the month. It is necessary to continue to pay attention to the progress of domestic aluminium production resumption and the recovery of downstream demand.