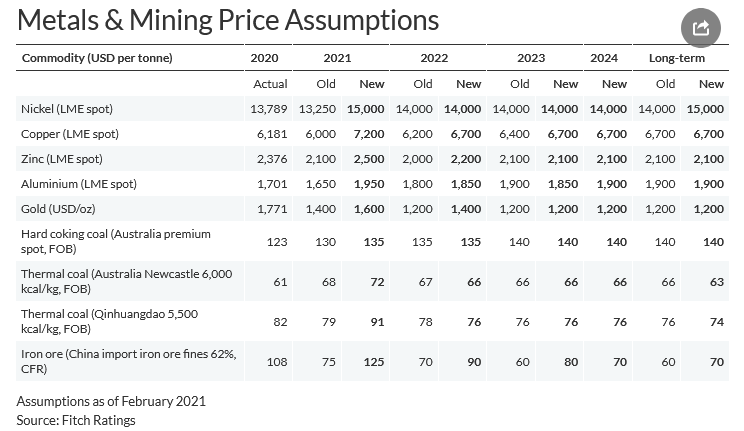

Fitch revises forecast in metals and ore prices

London – Fitch Ratings has revised some of its metals and mining price assumptions as prices for many commodities will benefit in the short term from returning demand while the supply response remains slow and inventories are running low.

Its revision of all iron ore price assumptions is the most significant change and is driven by tight market supply, which Fitch expect to continue in the next couple of years, and the absence of material new projects over a long period that could offset depleting mines.

Vale has cut its production guidance for 2021, resulting in no supply response to growing demand, with all large-scale iron ore producers operating at almost full capacity. Inventories are running low, while Fitch expects additional demand linked to US and European economic stimulus packages.

It has increased the short-term copper price assumption due to strategic purchases by the China State Reserve Bureau and supply risks in 2021, including renewals of labour contracts in Chile and Peru, which may result in strikes.

Medium-term prices will be supported by balanced market and energy transition trends as copper is used in charging infrastructure, cabling, electric vehicles, wind generators and transformers.

Zinc price assumptions have increased for 2021 and 2022 due to growing demand in China. Zinc production is price-sensitive and mine supply of concentrates will catch up relatively quickly.

Aluminium price assumptions for 2021 has raised on a stronger demand recovery in China, particularly from the automotive and solar energy sectors, and re-stocking outside of China, particularly in Europe.

However, Fitch expects a production surplus outside of China to persist, causing prices to soften once pent-up demand is satisfied. Prices will recover longer-term due to incremental demand growth.

Gold price assumptions have been raised for 2021 and 2022 on increased demand due to investment flows and central bank purchases. Fitch believes that prices will moderate in the medium term to an equilibrium of USD1,200/oz.

The rise in the 2021 coking coal price assumption is due to robust demand from the steel sector, supported by recovering steel production in India, Japan, South Korea and Europe, and rebalanced flows of seaborne coal despite ongoing restrictions on Australian coal imports to China.

Fitch expects coal demand to grow in the medium and long term, but final decisions on new projects were delayed in 2020. This means that capacity expansions that were due to take place in 2021-2023 will be delayed until 2024 or 2025. Supply will therefore remain tight, supporting medium- and long-term price assumptions.

The upward revision of the 2021 Qinhuangdao 5,500 kcal/kg coal price assumption reflects strong prices at the start of 2021, which it expects to reduce as demand normalises in the rest of the year.

Fitch expects the price to align with our medium-term price assumption in 2022 due to growing renewables and increased approvals for greenfield mines. It has lowered the long-term price reflecting China’s ambition to achieve carbon-neutrality by 2060, meaning that carbon emissions, including those from coal consumption, will peak by 2030.

The revision in the 2021 Newcastle 6,000 kcal/kg coal price reflects higher year-to-date prices. However, these will prompt operations at costlier mines to resume leading prices to moderate in line with our medium-term assumptions. The long-term price adjustment reflects a gradually normalising price gap with the Chinese benchmark.

Fitch has raised nickel price assumptions for 2021 due to strong spot prices and its expectation of increasing demand in 2021 for stainless steel; a key consumer of nickel. Fitch has increased our long-term assumption as we expect the increased use of nickel in batteries to lead to a market deficit from 2025.