Geopolitical tensions: Gold can act as a flight to safety instrument

Russia invaded Ukraine on February 24, 2022, and since then, the S&P 500 is up approximately 27.5%. Hamas attacked Israel on October 7, 2023, and since then the S&P 500 is up approximately 29.7%. US-based risk assets anchored around regulated exchanges, on the longer term, are sensitive to domestic fundamental factors such as interest rates and inflation. If anything, geopolitical tensions outside the US tend to prop up US-based assets.

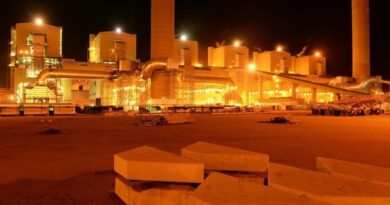

On-shoring or near-shoring capabilities of the US are more formidable than in the past. A good example is the construction of the new 1,100-acre development of TSMC’s advanced semiconductor manufacturing fabrication facility in Phoenix, Arizona. As things get tense overseas, the US can and will pivot.

Another potential result would be a shakeup in the oil market. Regarding Crude Oil, OPEC+ seems to be losing its primacy with respect to setting global oil prices. With a potential increase in production being contemplated by OPEC+, the attitude seems to be ‘if you can’t beat them, join them.’

As for Bitcoin, it is too esoteric and volatile to be considered a flight to quality investment. Most investors struggle to explain what Bitcoin is and its practical purpose clearly. Bitcoin futures average true range based on a 14-day look back is over $3,000 or more than 5% on any given day. I would think that flight to quality assets would not typically subject investors to 5% daily fluctuations, which would defeat the purpose. Furthermore, the supply of Bitcoin is highly inelastic, more so than gold.

Gold, on the other hand, can act as a flight to safety instrument. Major industrial countries that can afford it have been adding to their gold reserves, most notably the US, Russia, China, Japan, Singapore, and Brazil. This is arguably one of the main reasons for gold’s recent appreciation. This accumulation of reserves will reduce supply for the rest of us resulting in additional appreciation as investors completely buy in.

As for the U.S. dollar, it is believed that the US will maintain its world reserve currency status. The dominance of US foreign aid contributions and that of the European Union helps lock emerging economies’ dependency on the US dollar and EURO concerning transactions for goods and services. Central clearing, strong GDP, and strong contract law will be barriers for alternative currencies becoming dominant.

If there is another major global war, it will look and be fought completely differently than in the past. The currencies that will do well will be between alliances that can maintain good contract law during the conflict. Deep pockets certainly will help. Having said that, let’s pray that a World War II level conflict never happens.