Graphite Industry slows down amid COVID-19

As the COVID-19 virus spread across China, the largest producer of both natural and synthetic graphite, mines and plants were relatively quick to re-open, with most being well away from the epicentre in Wuhan where lockdowns dragged on for longer, and ramping-up from end-February through March.

By the time, China’s economy was already operating back at 90% of capacity two months after the initial restrictions were imposed on Wuhan in late January.

Just as production came back online in China, lockdowns in Europe and North America began to have a significant negative effect on demand. With an estimated 40% of the global population confined by the end of the month, a consumer spending drop-off and manufacturing closures ensued.

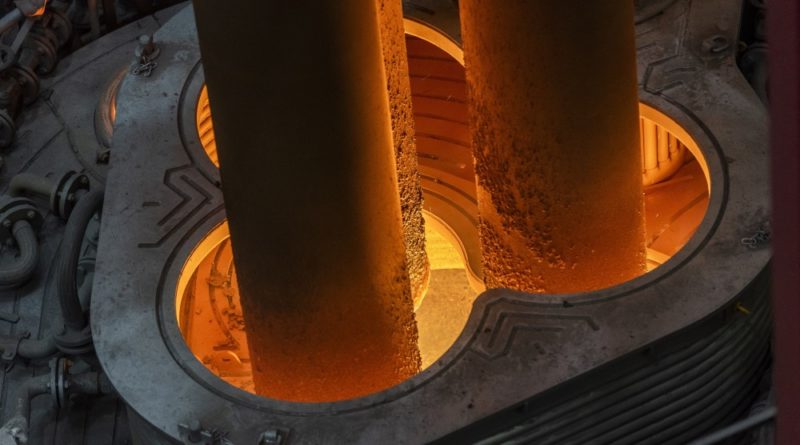

Production of steel slackened as steelmaking plants closed and demand declined from construction and infrastructure projects, affecting demand for refractories and other related industries.

Limping automotive and other transport divisions had a knock-on effect on the brake linings, foundries and lubricant industries. Nevertheless, EAF steel consumption continued to grow in China, with the tendency to growing accessibility of steel scrap mostly unconstrained by the pandemic.

Yet the battery segment has remained fairly strong. Suffering from weakness because of cuts to Chinese EV incentives that lowered battery demand in 2020, the demand had started to recover during the first few months of 2020, despite COVID-19.

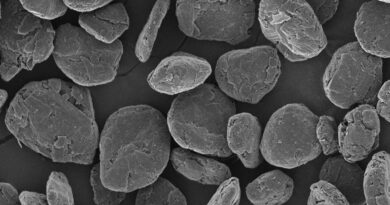

This was underlined by increasing exports of spherical graphite through to April. Whereas demand for batteries elsewhere declined in mid-2020, the key growth market in China has improved swiftly and is on the way on its very high growth potential.

The lithium-ion battery market is thus predicted to see growth for the full year 2020, followed by robust recovery in 2021.

With the Chinese GDP recovery, a 5-6% overall growth rate is forecast for graphite demand between 2021 to 2030, with much higher rates for batteries being the focus for the future of both natural and synthetic graphite. The Chinese government is also extending its EV incentive scheme for another two years which is expected to boost battery demand in the near-term.

Economies around the world have seen their GDP dropped down by 25-35% during periods of “full lockdown” and will take time to recover. China has been leading recovery so far with its industrial production, electricity and steel output up around 5% YoY and passenger car production up 11% YoY in June.