Ivanplats arranges US$420 million financing for Platreef

MOKOPANE, South Africa – Ivanhoe Mines’ South African subsidiary, Ivanplats, has signed a non-binding term sheet with Orion Mine Finance, a leading international provider of production-linked stream financing to base and precious metals mining companies, for a US$300 million gold, palladium and platinum streaming facility.

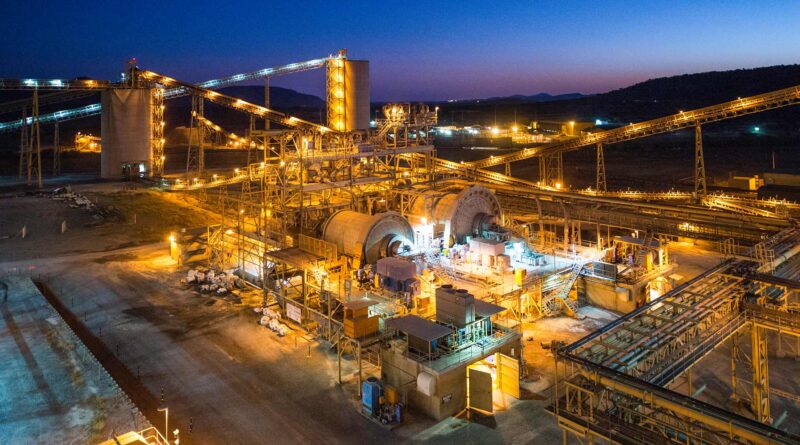

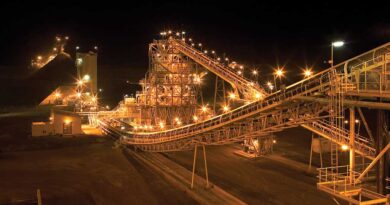

Ivanplats also has appointed two prominent, international commercial banks – Societe Generale and Nedbank – as mandated lead arrangers for a senior project debt facility of up to US$120 million. Both the stream financing and project debt facility will be used to advance the development of Ivanplats’ tier one Platreef palladium, platinum, rhodium, nickel, copper and gold project in Limpopo province, South Africa, toward initial production.

The initial capital cost for the phased development plan envisaged under the Platreef 2020 preliminary economic assessment, starting at a mining rate of 700,000 tonnes per annum (700 ktpa), is estimated at US$390 million.

Detailed engineering is underway on the mine design, 770-ktpa concentrator and associated infrastructure for the phased development plan, which is scheduled to be incorporated into an updated feasibility study before the end of 2021. The Shaft 1 changeover is progressing well in preparation for permanent hoisting by early 2022.

Platreef’s budget for 2021 is US$59 million, which includes US$10 million for commencement of headframe construction for Shaft 2. The first draw from the streaming funds, which is expected to occur shortly after establishment of the facility, is expected to fully cover Platreef’s 2021 budget.

The recently-completed sinking of Shaft 1 creates the opportunity to access early, high-grade tonnes in this scenario. While the 700-ktpa initial mine is being operated using Shaft 1, there would be opportunities to refine the timing of subsequent phases of expanded production, which is driven by the sinking of Shaft 2. Once completed, two 2.2-Mtpa concentrator modules would be commissioned, and the initial concentrator would be ramped up to its full capacity of 770 ktpa – increasing the steady-state production to 5.2 Mtpa.

The Platreef IDP20 reflects the first phase of development for the Platreef Mine. It is designed to establish an operating platform to support potential future expansions up to 12 Mtpa, as demonstrated in previous studies.

This would position Platreef among the largest platinum-group-metals producing mines in the world, producing in excess of 1.1 million ounces of palladium, platinum, rhodium and gold per year.

Ivanhoe Mines indirectly owns 64% of the Platreef Project through its subsidiary, Ivanplats, and is directing all mine development work. The South African beneficiaries of the approved broad-based, black economic empowerment structure have a 26% stake in the Platreef Project.

The remaining 10% is owned by a Japanese consortium of ITOCHU Corporation; Japan Oil, Gas and Metals National Corporation; ITC Platinum Development Ltd., an ITOCHU affiliate; and Japan Gas Corporation.