Major miners cash big in this year’s commodity boom

The world’s top-5 western diversified miners have earned a combined $85 billion for the first half of the year, based on experts’ estimates, which is more than double the level from last year.

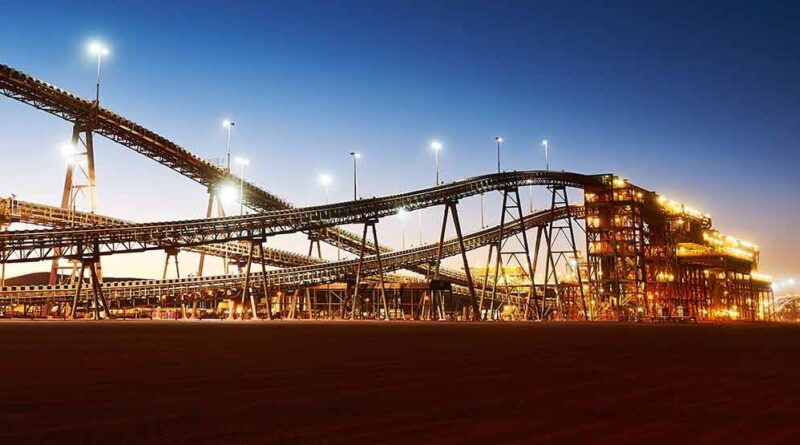

The mining industry has been one of the biggest beneficiaries from the world’s efforts to emerge from the pandemic. The trillions poured into recovery packages have sparked demand for commodities like iron ore, steel, copper and aluminium, pushing prices rapidly higher and feeding inflation pressures around the globe.

And while previous booms enticed the industry into ambitious investment plans to build and expand mines, many commodity producers this time appear content to return their profit windfalls to investors. The two biggest – BHP Group and Rio Tinto have already been channelling record dividends to shareholders.

Each of the cluster of five majors, which also includes Anglo American, Glencore and Vale, are expected to report their biggest-ever earnings for the six months through June, says Bloomberg.

Iron ore has been a big driver of profit for the majors. The world’s biggest commodity after oil hit a record in the first-half, and has spent the last three months hovering around $200 a ton, a level not seen in a decade. Steel and copper prices both set fresh records this year, thermal coal has also soared, and even diamonds have had a resurgence. Commodity prices across the board remain historically high for now.

Anglo American Platinum, 79% owned by Anglo American, paid out a record dividend of $3.1 billion that equates to 100% of first-half headline earnings.

For the iron ore miners such as Vale, BHP and Rio, it promises to be even better. Demand for the steelmaking ingredient, especially from China, is rampant and supply is constrained. China, which accounts for about half of global steel production, is making a record amount of the metal, while iron ore supply has never recovered from two dam disasters in Brazil.