Kumba Iron Ore: total production decreased by 21% to 8.3Mt

Centurion – Kumba in its production and sales report for the first quarter ended 31 March 2022 reports that total production decreased by 21% to 8.3Mt, due to high rainfall and equipment reliability caused by continued spares supply challenges, both of which impacted the availability of plant feedstock. Total sales decreased by 8% to 9.5Mt, as a result of rail constraints and low levels of available stock at Saldanha Port.

The finished stock was reduced to 5.1Mt from 6.1Mt on 31 December 2021. The strong average realised FOB export iron ore price was US$169 per wet metric tonne (wmt), equivalent to US$172 per dry metric tonne (dmt), above the average benchmark price of US$122/wmt or US$124/dmt.

Kumba’s Chief Executive, Mpumi Zikalala, said: “Seasonal weather-related events and equipment reliability constraints led to challenging operating conditions in the first quarter of the year. Pleasingly, we continued to see strong demand for our high-quality products, resulting in an average realised price 38.5% above benchmark prices.

“Given the tough operating conditions, our production and sales volumes decreased by 21% and 8%, respectively. We are therefore adjusting our production and sales guidance for the full year 2022 to between 38 and 40Mt (previously between 39 and 41Mt). Concurrent to this, we have revised our

C1 unit cost guidance to $44/t (previously $41/t) to reflect the revised production guidance, as well as inflationary pressure, including higher diesel and explosives costs.

“Progressing our near-term priorities of operational excellence, cost efficiencies and realising the full value of our premium product has become even more important and we are fully focused on delivering improvements across these priorities. From a responsible business perspective, we are encouraged that despite the operational challenges, we have maintained our safety performance and our fatality-free track record has increased to five years and ten months.”

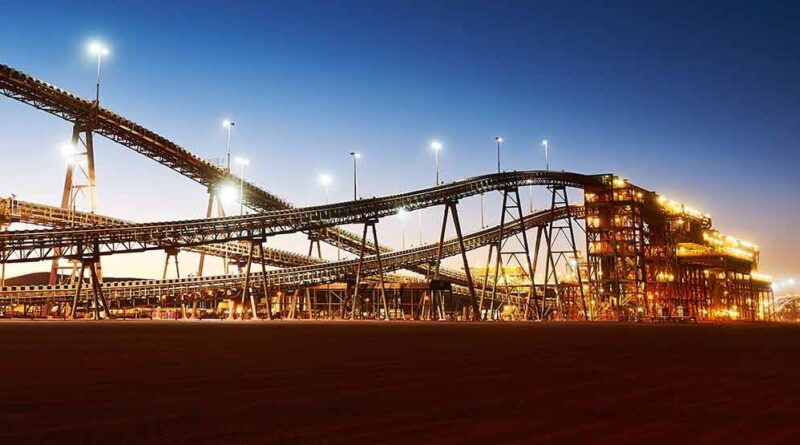

MINING AND PRODUCTION

Despite high seasonal rainfall hampering operational activities, particularly at Kolomela, total waste stripping increased by 6% to 46.7Mt (Q1 2021: 44.1Mt). At Sishen, waste stripping increased by 23% to 35.7Mt (Q1 2021: 29.1Mt), demonstrating the effectiveness of the rain readiness plans implemented in 2021, which included the redeployment of heavy mining equipment (HME) to less saturated areas of the mine. However, this redeployment did impact the availability of plant feedstock. During the period, Kolomela experienced more than double the rainfall at Sishen (428mm compared to 207mm). While rain readiness plans were in place at the mine, the significant volume of water proved challenging. Consequently, waste stripping decreased by 27% to 11.1Mt (Q1 2021: 15.1Mt).

In addition to weather related impacts, we continued to experience equipment reliability issues due to the global shortage of HME spares which is largely due to the cumulative effect of Covid-19 and geopolitical disruptions. Accordingly, a strong focus has been placed on implementing our reliability programs and managing the spares situation with our supply teams and original equipment manufacturers. Furthermore, we have deployed additional mining contractor resources in line with our mine plan requirements.

Plant stability was impacted by feedstock constraints emanating from the mining challenges described above. These resulted in total production volumes decreasing by 21% to 8.3Mt (Q1 2021: 10.6Mt), with production at Sishen decreasing by 18% to 5.8Mt (Q1 2021: 7.1Mt) and Kolomela by 29% to 2.5Mt (Q1 2021: 3.5Mt). Critical plant maintenance was brought forward during the period to reduce potential disruptions to production going forward, as ore supply is ramped up.

LOGISTICS, SALES, AND MARKETING

Ore railed to port decreased by 1% to 9.1Mt (Q1 2021: 9.2Mt). This, coupled with lower production volumes led to a 1Mt decrease in closing finished stock of 5.1Mt (31 December 2021: 6.1Mt), with 4.3Mt held at the mines. The rail line was also impacted in the period by severe weather conditions which resulted in washouts as well as the continued plague of locusts in the Northern Cape region. As a result of rail constraints and low stock levels at Saldanha Port, export sales decreased by 7% to 9.5Mt (Q1 2021: 10.2Mt). We continue to work closely with Transnet to improve the efficiency of the line.

Kumba achieved an average lump:fine ratio of 65:35 and product quality of 64.0% Fe. This translated into an average realised FOB export iron ore price of US$169/wmt (equivalent to US$172/dmt), outperforming the average benchmark Platts 62 index FOB price of US$122/wmt (equivalent to US$124/dmt).