National Treasury backtracks on plans to raise additional R40 billion

The 2021 Budget shifts numbers across the balance sheet to make it look good. There’s good news and there’s bad news. The National Treasury has backtracked on plans to raise an additional R40 billion personal taxes over the next four years. But, as is customary at this time of the year, you’ll be paying more for petrol, cigarettes and alcohol as sin taxes rise.

The 2021 Budget of R2.02-trillion is set against a debt-to-GDP level of 80.3%, stabilising at 88.9% in 2025. After an economic contraction of 7.2%, the National Treasury now forecasts growth of 3.3% in 2021, followed by 1.9% growth for the following two years.

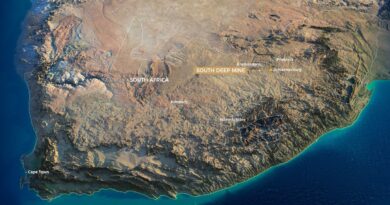

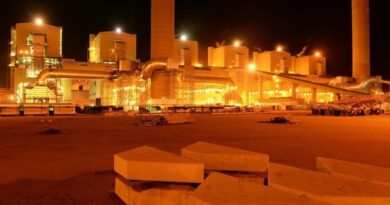

Finance Minister Tito Mboweni’s annual budget appears to have been well received yesterday, with the rand strengthening and the yield on government bonds declining. Better than expected revenue collection for the year was supported by rising commodity prices, which have fed into stronger earnings for mining companies.

Over the next three years R9-billion is allocated to Covid-19 vaccines, with R5.85-billion available immediately in 2021. That’s R4.35-billion for the national health department, and R1.5-billion for its provincial counterparts, with a buffer built into the government’s contingency that increases to R12-billion.

The rand seemed to briefly strengthen on the Budget, presumably in no small ways over the public sector wage freeze, and perhaps also on the R2.2-billion tax relief by raising brackets – and the corporate tax rate’s drop to 27%, even if that’s only from April.