Newmont claims to have world’s best gold and copper operations

Higher gold prices and solid production drove fourth-quarter earnings for the world’s largest gold miner.

Ahead of the North American trading session, Newmont Corporation (NYSE: NEM) reported adjusted net income of $486 million or $0.50 per share for the fourth quarter of 2023, up sharply compared to $286 million or $0.36 per share reported in the third quarter.

The adjusted income didn’t include $2.5 billion in losses due to impairment charges and the $464 million spent to buy Australian-based Newcrest.

The company’s earnings in the year’s final three months slightly missed analyst expectations, as consensus estimates called for earnings per share of around $0.63.

Tom Palmer, Newmont’s President and Chief Executive Officer, described 2023 as a transitional year as the company looks forward to the new year.

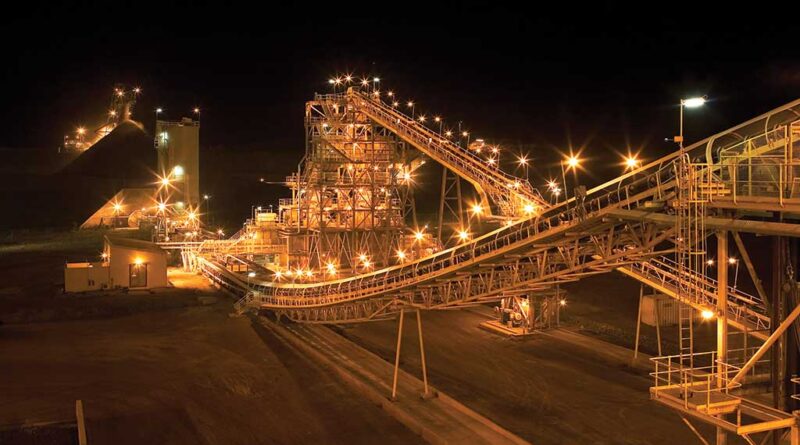

“With the acquisition of Newcrest now complete, our principal focus for 2024 is to integrate and transform our leading portfolio of Tier 1 assets into a unique collection of the world’s best gold and copper operations and projects. With stable production and structured reinvestment throughout the year, we are strongly positioned to deliver on our commitments in 2024 and set the stage for meaningful growth in 2025 and beyond,” Palmer said in the earnings report.

Looking at production, Newmont said that last year, it produced 5.5 million gold ounces and 891 thousand gold equivalent ounces (GEOs) from copper, silver, lead, and zinc, which is in line with revised guidance. Production was down slightly compared to 5.96 million ounces of gold produced in 2022.

However, the company said it saw an average realized gold price of $1,954 per ounce last year, up from $1,792 in 2022.

Looking at the company’s future, Newmont said it increased its gold reserves to 136 million ounces with resources of 174 million ounces.

However, Newmont’s production profile is going to look a lot different in the future, especially in Canada as the company looks to sell its Canadian projects.

The Company said that it intends to divest six non-core assets, including Éléonore, Musselwhite, Porcupine, CC&V, Akyem, and Telfer operations, as well as two non-core projects, Havieron and Coffee.

Newmont also said it will cut its dividend as part of what it described as its balanced capital allocation strategy.