Northam Platinum: Continued progress of organic growth projects

Johannesburg – Total revenue per platinum ounce sold decreased by 11.3% to R73 828/Pt oz, from R83 277/Pt oz in F2021. This resulted in a cash profit margin per platinum ounce of 53.9% (F2021: 65.6%).

The minor metals, iridium and ruthenium, continue to perform well, with average USD metal prices per ounce increasing by 10.8% and 58.2% respectively. It is expected that iridium and ruthenium, which are critical to the growing hydrogen economy, will become increasingly significant contributors to Northam revenue.

Base metals also performed well with the USD price of nickel and chrome increasing on average by 44.8% and 54.2%, respectively, and the average USD price for copper increasing by 19.1%, on a per tonne basis.

Despite the planned rebuild and upgrade of smelter furnace 1 during the first half of F2022 total refined volumes increased by 9.7% to 719 580 oz 4E (F2021: 655 741 oz 4E). The services of a second precious metal refiner were engaged during F2022, to cater for the group’s medium to long-term production growth profile.

Concentrate sold to a third party to honour legacy offtake agreements relating to the Everest and Maroelabult operations contained 36 305 oz 4E (F2021: nil). Refined metal sold to the group’s customers totalled 701 618 oz 4E (F2021: 654 057 oz 4E).

During the first half of F2022, Northam made a strategic investment by acquiring a significant shareholding in RBPlat, as published on 9 and 19 November 2021. Further acquisitions by Northam of RBPlat shares were announced on 7 December 2021.

Northam believes that its investment in RBPlat holds the potential for substantial long-term value creation. It provides inherent optionality and its complementary metal mix, with a higher relative platinum contribution, fits well within the broader Northam basket. The RBPlat assets are young, shallow, large, well-capitalised and occupy a strategically important position in the Western Bushveld.

CAPITAL EXPENDITURE

Capital expenditure increased to R4.6 billion (F2021: R3.3 billion). This is in line with its capital schedule and is the combined result of increased expansionary capital of R3.1 billion (F2021: R1.8 billion), together with a marginal decrease in sustaining capital expenditure to R1.4 billion (F2021: R1.5 billion).

Expansionary capital expenditure increased as a result of significant development on the Western extension project at Zondereinde, together with the ongoing ramp-up at Eland. Sustaining capital expenditure at Booysendal increased due to a number of extensions to strike belts and the first significant fleet replacements, whilst sustaining capital requirements at its metallurgical operations decreased following the commissioning of the rebuilt smelter furnace 1 at Zondereinde.

Significant ongoing expansion is planned for the Western extension at Zondereinde, as well as at Eland, over the next two years. Consequently, group capital expenditure for the current financial year is estimated to amount to R5.4 billion.

At Zondereinde mine, stoping is ramping-up within the Western extension and further progress has been made on the deepening project. Reaming of number 3 shaft was completed during April 2022 and equipping is in progress. Pilot drilling of 3a ventilation shaft commenced during the second half of the year and has reached a depth of 650 metres.

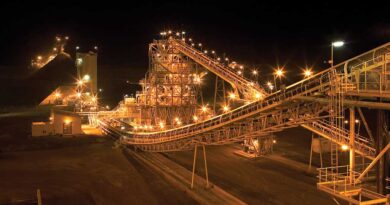

Both shafts are scheduled to be commissioned during the 2024 financial year. At the metallurgical facilities, upgrades to the material handling infrastructure, together with the planned rebuild of smelter furnace 1, were completed. Capacity upgrades at the base metal removal plant have commenced, in line with its growth profile.

The development of an 11 MW solar power farm to provide electricity to the metallurgical complex commenced. The design and permitting phases for this installation have been concluded and earthworks are in progress.

The development of Booysendal South is progressing well , and the steady state complement of stoping crews is in place. despite work stoppages due to community unrest in the region.

At Eland mine, processing of ore from surface sources continues, whilst underground and open pit feed are being batch treated. Development of the Kukama decline system has progressed well, as has strike development to connect with Maroelabult mine, which was purchased from Barplats Mines Proprietary Limited, a subsidiary of Eastern Platinum Limited.

Underground stoping ramp-up is in progress. In addition, open-pit mining of UG2 commenced in the eastern portion of the Eland mining right during the first quarter of the financial year. First ore was delivered to the concentrator during the second quarter of the financial year.