Northam refined PGM decreased marginally to 351 koz in H1 F2022

Whilst the operating environment has been particularly challenging, Northam believe that the period under review has been important for Northam, given:

- the significant progress made in respect of the group’s organic growth projects;

- the successful acceleration of the maturity of the Zambezi BEE transaction and value unlock for BBBEE;

- the c. 30% share repurchase;

- the establishment of a new group structure and the listing of Northam Holdings; and

- a significant strategic investment in RBPlat, coinciding with the introduction of RBH as an important empowerment shareholder of Northam.

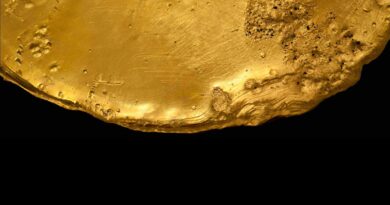

The group’s equivalent refined PGM metal from own operations decreased marginally to 351 359 oz 4E (H1 F2021: 352 741 oz 4E), as a result of challenging operational circumstances experienced during the period under review and was largely attributable to lower production at Zondereinde.

The Zondereinde and Booysendal mines experienced particularly difficult operational environments during this period. Tragically, Zondereinde suffered two mining related fatalities, together with increased medical absences relating to the ongoing COVID-19 pandemic. Furthermore, regional community unrest resulted in various production stoppages at Booysendal. These factors negatively impacted the group’s metal production as well as unit cash costs.

Group unit cash costs per equivalent refined platinum ounce increased by 18.6% to R32 814/Pt oz

(H1 F2021: R27 660/Pt oz) as a result of cost increases at all operations. Zondereinde’s unit cash costs escalated by 21.3% to R34 544/Pt oz (H1 F2021: R28 473/Pt oz), with a corresponding increase of 19.1% at Booysendal to R24 158/Pt oz (H1 F2021: R20 288/Pt oz), and a 7.9% increase at Eland to R42 583/Pt oz (H1 F2021: R39 476/Pt oz). These increases were the result of higher input costs and lower than anticipated production volumes. Higher input costs were the result of an increase in the number of employees in service as the group continues to grow the labour component to enable the planned expanded production profile, as well as higher than normal inflation relating to, in particular, electricity tariffs and consumables such as diesel, steel and chemicals.

Despite the challenging operating environment, the group’s expansionary projects remain on track. Development of the Western extension at Zondereinde has progressed well. Booysendal has made good progress on South mine, whilst recording seven million fatality free shifts and remaining fatality free since inception.

Eland mine continues to ramp-up and the addition of the recently acquired Maroelabult section, transferred in January 2022, provides flexibility which will positively impact the overall mine build programme.

Equivalent refined production from own operations for the full financial year ending 30 June 2022 is forecast to be between 680 000 and 710 000 oz 4E. This will result in an estimated unit cash cost per platinum ounce of between R33 000 and R34 000, assuming no further adverse inflationary pressure during the remainder of the current financial year.

Sales volumes were impacted by the planned rebuild and upgrade of smelter furnace 1 at the Zondereinde Metallurgical complex (furnace 1) which commenced during May 2021 and was successfully completed at the end of October 2021.

Sales revenue for the period amounted to R13.9 billion, an increase of 16.8% from the previous corresponding period (H1 F2021: R11.9 billion). This increase was the combined result of softer PGM sales volumes (309 255 oz 4E versus 315 320 oz 4E in H1 F2021) in light of the furnace 1 rebuild and upgrade and higher USD basket prices, which prices were somewhat offset by a stronger ZAR/USD exchange rate.

The average USD basket price achieved increased by 22.5% to USD2 647/4E oz, from USD2 160/4E oz in H1 F2021. This benefitted from an 8.0% increase in the average platinum price to USD1 009/oz (H1 F2021: USD934/oz), together with a 15.7% increase in the average rhodium price to USD15 385/oz (H1 F2021: USD13 296/oz).

The price of minor metals, iridium and ruthenium, continue to perform well, increasing by an average of 147.8% and 127.5% respectively, during the period under review. It is expected that iridium and ruthenium, which are critical to the growing hydrogen economy, will become increasingly significant contributors to the group’s revenue.

Total revenue per platinum ounce sold increased by 14.4% to R70 140/Pt oz, from R61 307/Pt oz in H1 F2021, resulting in a cash profit margin per platinum ounce in excess of 50%.

Sales volumes are expected to increase during the second half of the 2022 financial year as inventory built up ahead of the smelter is being processed. Sales guidance for the full financial year is between 720 000 and 740 000 oz 4E, with 770 000 to 800 000 oz 4E expected to be delivered to the group’s refiners.